IMF report: Govt allays fear over debt

[ad_1]

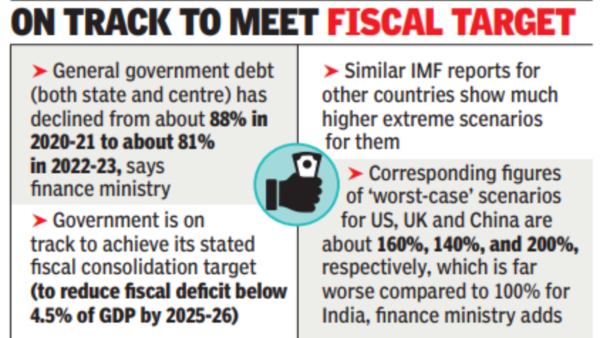

“Among the various favourable and unfavourable scenarios given by the IMF, under one extreme possibility, like once-in-a-century Covid-19, it has been stated that the general government’s debt could be “100% of debt to GDP ratio” under adverse shocks by FY2028.It talks only of a worst-case scenario and is not fait accompli,” the ministry said in response to reports expressing concern over the country’s debt levels based on the observations of the IMF in its Article IV report. Under Article IV of the IMF’s articles of agreement, the IMF holds bilateral discussions with members, usually every year and they serve as a health check for the economies and policies being pursued by respective governments.

The ministry pointed out that general government debt in India is overwhelmingly rupee-denominated, with external borrowings (from bilateral and multilateral sources) contributing a minimal amount and this has been highlighted in the IMF report.

It also said that domestically issued debt, largely in the form of government bonds, is mostly medium or long-term with a weighted average maturity of roughly 12 years for central government debt. “Therefore, the roll-over risk is low for domestic debt, and the exposure to volatility in exchange rates tends to be on the lower end,” said the finance ministry statement.

It also said that similar IMF reports for other countries show much higher extreme scenarios for them. The corresponding figures of ‘worst-case’ scenarios for the US, UK and China are about 160%, 140%, and 200%, respectively, which is far worse compared to 100% for India.

“It is also noteworthy that the same report indicates that under favourable circumstances, the general government debt to GDP ratio may decline to below 70% in the same period,” according to the finance ministry statement. It said that the shocks experienced this century by India were global in nature, which included the global financial crisis, taper tantrum, Covid, Russia-Ukraine War, among others These shocks uniformly affected the global economy and barely few countries remained unaffected. Therefore, any adverse global shock or extreme event is expected to unidirectionally impact all the economies in an interconnected and globalised world.

#IMF #report #Govt #allays #fear #debt