Soon, know real time if NEFT, internet banking, UPI, mobile banking are working or down with new banking dashboard

[ad_1]

According to an ET report, the RBI aims to address the issue of service outages in internet banking and other payment channels by offering more transparency and real-time information to customers.

An official, who wished to remain anonymous, stated that the new portal will also include information on the availability of facilitation channels such as internet banking applications, mobile banking, and other payment and settlement systems like RTGS, NEFT, and UPI.Additionally, a bank executive mentioned that the RBI intends to provide customers with real-time updates on outages, enabling them to conduct transactions through alternative payment methods. This will also encourage banks to promptly address the issue through an incident response plan and improve system capacity management.

Banks have been requested to inform the regulator whether a common platform can be established or if individual banks should have their own platforms.

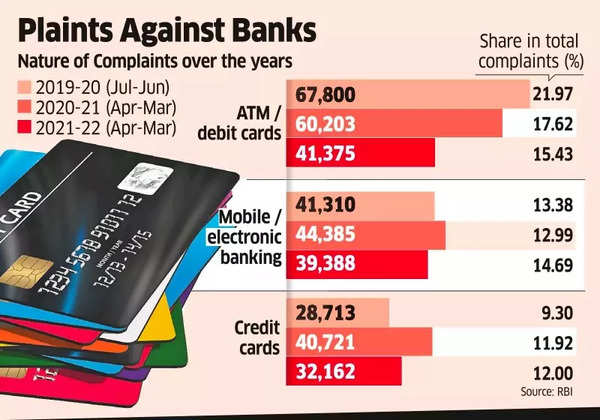

Complaints against banks

The same bank executive explained that sometimes, bank outages can occur due to the failure of IT systems, which are outsourced to third-party vendors. This initiative will ensure greater oversight of these entities, the executive said.

Service outages have been a persistent issue for banks worldwide. Earlier this year, Canadian bank Laurentian replaced its CEO following an IT outage. The new management’s immediate focus was to mitigate the impact of a mainframe outage that occurred during a planned IT maintenance update.

In 2020, the RBI temporarily halted HDFC Bank, a private lender, from launching any new digital business activities under its ‘Digital 2.0’ program and acquiring new credit card customers. This action was taken due to incidents of outages in internet banking, mobile banking, and payment utilities experienced by the bank’s customers. The restrictions were lifted in March 2022.

#real #time #NEFT #internet #banking #UPI #mobile #banking #working #banking #dashboard