Investment declaration time: Did you opt for the new tax regime by mistake? Here’s what that means for ITR filing

[ad_1]

This year’s Budget 2023 has made the new tax regime the default choice for salaried taxpayers. If you haven’t conveyed your preference to your employer, you will now be taxed under the new regime, according to an ET report.

The new tax regime offers a higher threshold for tax relief, broader tax slabs, and reduced tax rates. Under this system, if your taxable income doesn’t exceed Rs 7 lakh, no tax will be applicable. Combining this with the Rs 50,000 standard deduction reinstated this year, individuals with a taxable income of up to Rs 7.5 lakh won’t incur any tax liability. Additionally, there is no requirement for putting your money in tax-saving instruments.

Old vs New tax regime

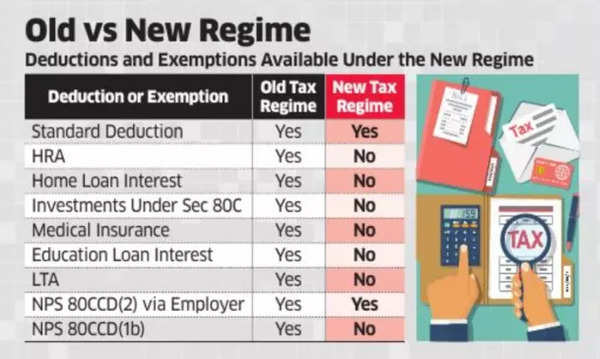

However, opting for this regime means forgoing several deductions and exemptions available under the old tax structure, such as HRA, LTA, and deductions for tax-saving investments, medical insurance, and interest on home and education loans.

Sudhir Kaushik, CEO of tax filing portal Taxspanner.com, highlights the need for taxpayers to assess whether they should opt for the new regime or continue with the old one.

Once your employer has deducted tax as per the chosen regime, it remains unchanged for the financial year. For those inadvertently placed under the new regime, there’s recourse during tax filing. Taxpayers can switch to the old regime while filing their returns and claim deductions that were overlooked, potentially leading to a refund if excess tax was deducted.

However, some exemptions cannot be reclaimed when filing tax returns. For instance, while HRA exemption is claimable, leave travel allowance exemptions cannot be asserted.

#Investment #declaration #time #opt #tax #regime #mistake #Heres #means #ITR #filing