Income Tax department scans financial dealings, tells assessees to pay advance tax

[ad_1]

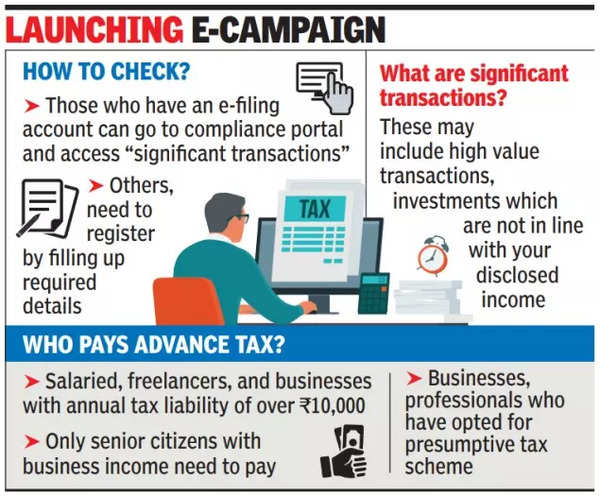

The tax authorities have identified taxpayers and entities where payment of taxes for 2023-24 is not commensurate with the financial transactions made by them so far this year and the idea is to urge them to pay their taxes. This is part of the taxpayer service initiative and the tax department is undertaking the e-campaign and urging individuals and entities through email and text messages to compute their advance tax liability correctly and deposit the due advance tax on or before March 15.

The law requires salaried, businesses and freelancers with liability of over Rs 10,000 to pay advance tax, which is to be deposited in four instalments with the last one due by Friday. Advance tax helps govt manage its resource flow better. Tax authorities receive information of specified financial transactions of taxpayers from various sources. “To increase transparency and to promote voluntary tax compliance, this information is reflected in the annual information statement (AIS) module and is available to the persons/entities for viewing. The value of ‘significant transactions’ in the AIS has been used for carrying out this analysis,” it said in a statement. It said that for viewing the details of significant transactions, the individuals and entities can login to their e-filing account, if an account has already been created, and go to the compliance portal. On this portal, the e-campaign tab can be accessed to view significant transactions.

The authorities have been using technology, including big data and artificial intelligence, to gather information and plug loopholes. They have also relied on technology to make it easier for taxpayers to access information electronically and significantly reduced the need for personal interaction with tax officers.

#Income #Tax #department #scans #financial #dealings #tells #assessees #pay #advance #tax