Healthcare: Healthcare may beat BFSI in Cognizant

[ad_1]

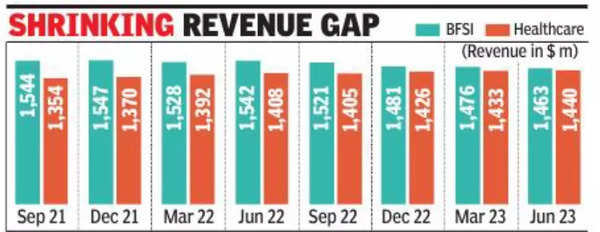

Cognizant’s BFSI revenue in the June quarter was $1.46 billion, while its healthcare is nipping at its heels at $1.40 billion. BFSI accounts for 31% of Cognizant’s revenue, and healthcare 29%. Considering that BFSI has been weak for most IT services companies, and healthcare IT spends are rising, the next quarter could see healthcare becoming Cognizant’s No. 1 vertical. For Accenture too, the health & public service vertical solidly beat financial services in its quarter ended May, the first time in many quarters.

Cognizant has an edge in the healthcare technology industry, so much so that its revenues from the segment is higher than the combined revenue from the segment for three of its biggest competitors — TCS, Infosys, and Wipro. In the June quarter, TCS clocked $759 million in healthcare revenue, Infosys $333 million, and Wipro $339 million.Cognizant’s financial services’ revenues declined 5% in the June quarter. Commentaries from IT firms have highlighted drop in discretionary spends, and delays in decision-making and ramp-ups. Cognizant’s health sciences revenue grew 2%, driven by demand from healthcare clients for integrated software solutions.

Cognizant CFO Jan Siegmund in a recent earnings call said, “We’re going to continue to see the pressure in financial services performing below our own hopes…And there’s some strength as you saw in the quarter and our strength on a relative basis in healthcare. And that reflects the strong market position that we have with our clients in healthcare.”

Phil Fersht, CEO of IT consultancy HfS Research, said Cognizant’s healthcare and life sciences business is the jewel in the crown for the firm – especially at a time when US healthcare is one of the hottest industries for IT services growth. “On the flip side, financial services, notably in the US and Europe, has been struggling with interest rate hikes and regional banks floundering, so it’s no surprise healthcare and life sciences will become its largest vertical,” he said.

Cognizant counts Aetna, United Healthcare, Pfizer, Merck, Anthem, and EmblemHealth, as customers in the healthcare segment. Cognizant straddles the space across payers, providers and pharmacies, providing process improvements, clinical trial management, regulatory compliance solutions and revenue cycle management for hospitals and health systems.

Recently, Cognizant expanded its relationship with biopharmaceutical company Gilead Sciences with a new deal valued at over $800 million over five years. Cognizant will manage Gilead’s global IT infrastructure, platforms, applications and advanced analytics, and lead initiatives designed to accelerate its digital transformation

Hansa Iyengar, senior principal analyst in London-based Omdia, said, “Cognizant has made some moves in the past few years that have enabled it to become a juggernaut in the healthcare services space. Its acquisition and integration of TriZetto has been a key aspect of this success. The vendor’s partnership with Microsoft to provide the TriZetto platform as a SaaS solution on Azure while leveraging Microsoft Cloud for Healthcare to meet the regulatory and security needs is a great move especially as the healthcare industry is ramping up efforts to modernize legacy systems and improve operational efficiencies.”

#Healthcare #Healthcare #beat #BFSI #Cognizant