Business

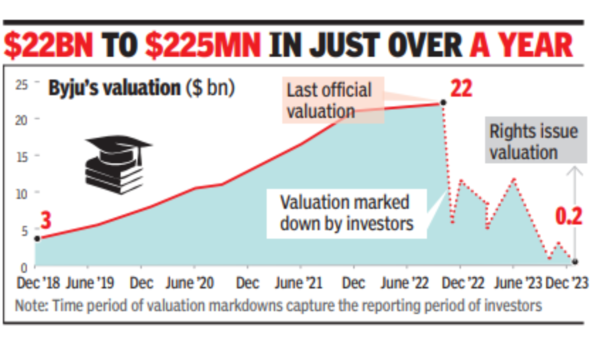

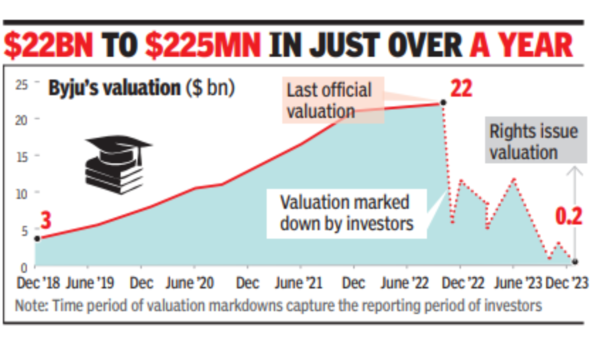

Byju’s eyes $200 million at 99% valuation cut

[ad_1]

MUMBAI: Troubled edtech startup Byju’s has launched a rights issue to raise $200 million from existing investors at a valuation of $225-230 million, a 99% drop from its peak valuation of $22 billion (October 2022) as it struggles with a funding crunch.

In a statement, the company said that the funds will be used to clear immediate liabilities and meet operational requirements.

“It has been 21 months since our last external capital raise, during which we have cut our burn and worked to become a lean organisation, razor-focused on execution. This capital raise is essential to prevent any further value impairment and to equip the company with necessary resources to deliver on its mission,” founder Byju Raveendran said in a note to shareholders, which was reviewed by TOI.

Raveendran claimed that the founders have infused over $1.1 billion into the company over the past 18 months. “In these uncertain times, we have not shied away from taking several tough decisions in the best interest of the company, and we will continue to do so in the coming months,” Raveendran said.

The Bengaluru-based startup, which was once chased by investors who collectively infused more than $5 billion into the firm, has recently been dragged to the insolvency tribunal by its foreign lenders over the company’s failure to repay a $1.2-billion term loan it had raised in 2021. Over the past months, the startup has seen several senior-level employees exit the company, a series of valuation markdowns by investors and has been mired in litigation. In much delayed filings, the startup last week revealed over Rs 8,000 crore in consolidated losses for FY22.

In a statement, the company said that the funds will be used to clear immediate liabilities and meet operational requirements.

“It has been 21 months since our last external capital raise, during which we have cut our burn and worked to become a lean organisation, razor-focused on execution. This capital raise is essential to prevent any further value impairment and to equip the company with necessary resources to deliver on its mission,” founder Byju Raveendran said in a note to shareholders, which was reviewed by TOI.

Raveendran claimed that the founders have infused over $1.1 billion into the company over the past 18 months. “In these uncertain times, we have not shied away from taking several tough decisions in the best interest of the company, and we will continue to do so in the coming months,” Raveendran said.

The Bengaluru-based startup, which was once chased by investors who collectively infused more than $5 billion into the firm, has recently been dragged to the insolvency tribunal by its foreign lenders over the company’s failure to repay a $1.2-billion term loan it had raised in 2021. Over the past months, the startup has seen several senior-level employees exit the company, a series of valuation markdowns by investors and has been mired in litigation. In much delayed filings, the startup last week revealed over Rs 8,000 crore in consolidated losses for FY22.

Raveendran said that Byju’s is less than a quarter away from achieving operational profitability. The company is yet to file its FY23 results. Since October 2022, the company has laid off more than 5,000 employees in a bid to check costs. It is also trying to sell some of its assets to repay the term loan.

#Byjus #eyes #million #valuation #cut