‘Banks are money creators, not intermediaries’

[ad_1]

Could you explain for our readers this new framework of money?

The crucial flaw of monetary theory, which relies on the theory of financial intermediation, is to treat banks as mere financial intermediaries, not money creators. Instead, in our book, we treat banks as “money creators”. In a bank, lending decisions are made independently by the credit division based on the borrower’s credit worthiness. Once the bank disburses a loan of Rs 1 lakh, it credits the borrower’s account with a deposit of Rs 1 lakh. It is important to understand here that banks create money ex nihilo (out of nothing). Conceptually, therefore, the direction of causality runs from bank loans to bank deposits and not vice-versa. As money supply in the economy is primarily contributed by deposits and loans cause deposits, banks are the primary money creators in an economy.

You say that central banks around the world pursue flawed monetary policies. What is the solution?

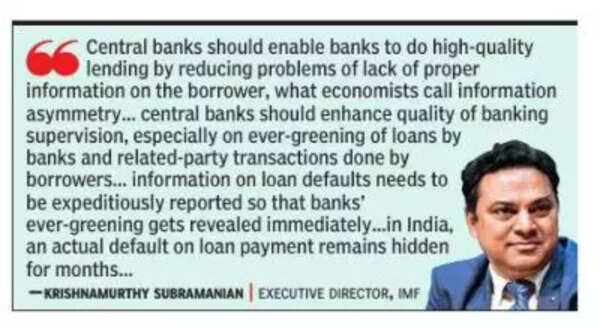

Banks create about 90% of the money. The role of the central bank as a regulator and supervisor is far more important than the role in monetary policy. Central banks should enable banks to do high-quality lending by reducing problems of lack of proper information on the borrower, what economists call “information asymmetry”. Second, central banks should enhance the quality of banking supervision, especially on ever-greening of loans by banks and related-party transactions done by borrowers. Central banks must ensure appropriate carrot-and-stick for bank auditors so that they do not overlook ever-greening of loans and ensure full disclosure of related-party transactions by borrowers. Third, information on loan defaults needs to be expeditiously reported so that banks’ ever-greening gets revealed immediately. In the advanced economies, even a technical default like violation of a bank loan covenant must be reported immediately. In contrast, in India, even an actual default on loan payment remains hidden for months. This needs to change.

Do you think the world will be convinced by this new monetary theory?

In economics, theories are developed for a make-believe world and then when the real world does not fit the theory, such phenomena are labelled “puzzles”. To me, this epistemology of economics has been an enduring “puzzle”. I had argued in the first box of the 2018-19 economic survey – my first as the CEA – that economists living in their ivory towers often construct theories that are departed from the real world. No wonder, common folks rarely relate to the make-believe world economists inhabit.

#Banks #money #creators #intermediaries