Business

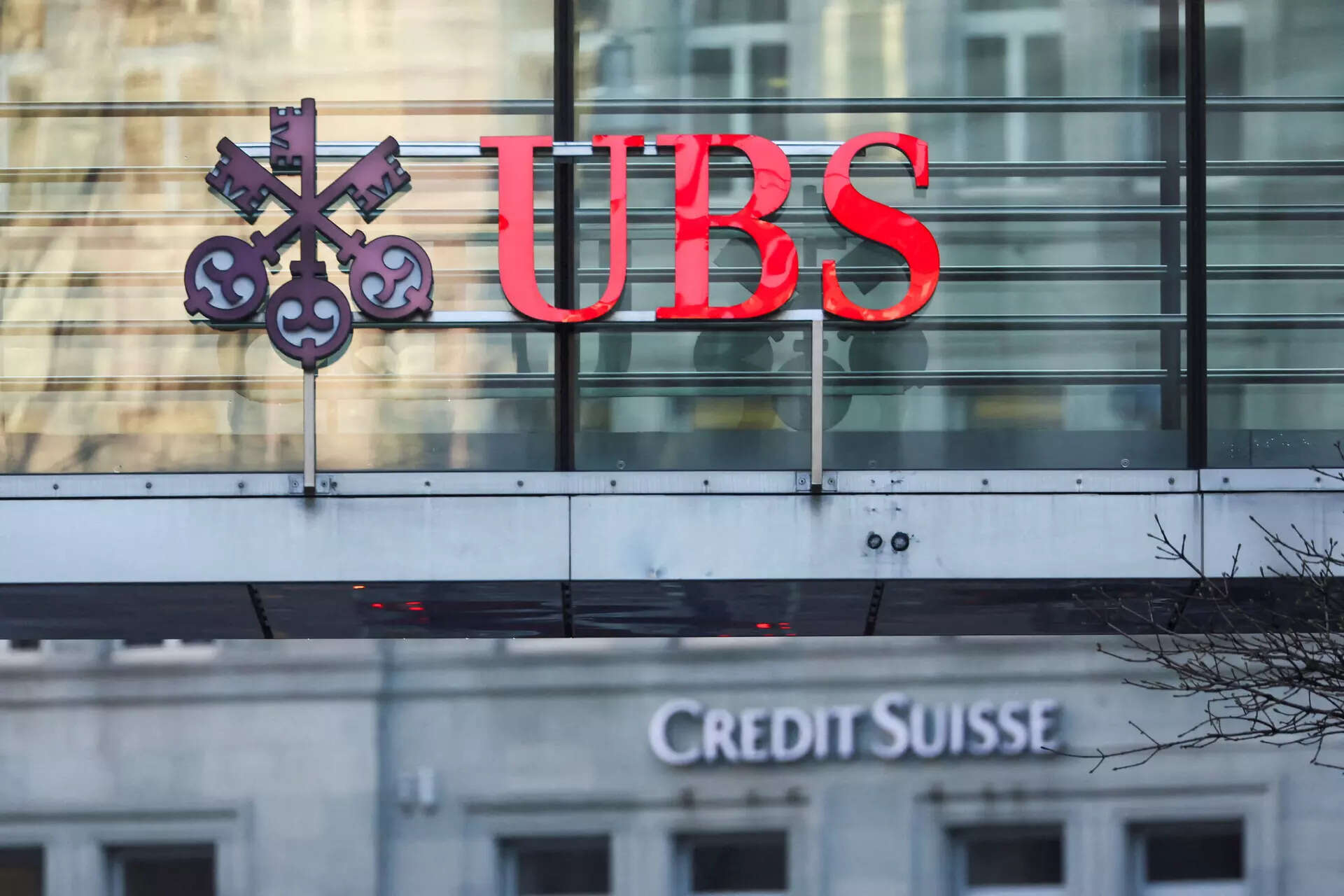

Banking giant UBS to absorb Credit Suisse’s domestic bank

[ad_1]

ZURICH: UBS Group said on Thursday it would fully absorb Credit Suisse’s domestic bank – a decision that comes despite a likely backlash in Switzerland where it could result in the loss of thousands of jobs.

The long-awaited announcement was made in tandem with UBS’s first earnings report since taking over its stricken rival.

UBS could have spun off the business and floated it in an IPO but the domestic bank has been a solid profit-maker for Credit Suisse and last year it was the only division in the black.

“Our analysis clearly shows that a full integration is the best outcome for UBS, our stakeholders and the Swiss economy,” Chief Executive Sergio Ermotti said in a statement.

“The two Swiss entities will operate separately until their planned legal integration for 2024 with the gradual migration of clients onto UBS systems expected to be completed in 2025,” he added.

UBS revised up the amount of cost-savings it expects from the deal, predicting $10 billion by end 2026, which compares with an earlier estimate of $8 billion by 2027. Most savings are set to come from reducing headcount.

The shotgun marriage to its fallen rival at the behest of Swiss authorities – the first-ever merger of two global systemically important banks – has created both opportunities and risks for UBS.

On one hand, analysts note that UBS acquired Credit Suisse for a song – just 3 billion Swiss francs – while gaining a large asset base, good client relationships and talented employees.

Indeed, UBS shares have gained some 30% since the takeover was announced and are hovering around their highest levels in 15 years.

At the same time, analysts warn that the complexity and the hasty nature of the deal brings significant execution risks as UBS must aggressively cut jobs, shrink Credit Suisse’s investment banking operations and manage outflows as clients seek to spread risk.

UBS reported net profit of $29 billion for the second quarter.

The bumper profit is due to a huge one-off gain that reflects how the acquisition costs were far below Credit Suisse’s value. It was somewhat under a consensus estimate of $33.45 billion from a poll conducted by the bank.

The long-awaited announcement was made in tandem with UBS’s first earnings report since taking over its stricken rival.

UBS could have spun off the business and floated it in an IPO but the domestic bank has been a solid profit-maker for Credit Suisse and last year it was the only division in the black.

“Our analysis clearly shows that a full integration is the best outcome for UBS, our stakeholders and the Swiss economy,” Chief Executive Sergio Ermotti said in a statement.

“The two Swiss entities will operate separately until their planned legal integration for 2024 with the gradual migration of clients onto UBS systems expected to be completed in 2025,” he added.

UBS revised up the amount of cost-savings it expects from the deal, predicting $10 billion by end 2026, which compares with an earlier estimate of $8 billion by 2027. Most savings are set to come from reducing headcount.

The shotgun marriage to its fallen rival at the behest of Swiss authorities – the first-ever merger of two global systemically important banks – has created both opportunities and risks for UBS.

On one hand, analysts note that UBS acquired Credit Suisse for a song – just 3 billion Swiss francs – while gaining a large asset base, good client relationships and talented employees.

Indeed, UBS shares have gained some 30% since the takeover was announced and are hovering around their highest levels in 15 years.

At the same time, analysts warn that the complexity and the hasty nature of the deal brings significant execution risks as UBS must aggressively cut jobs, shrink Credit Suisse’s investment banking operations and manage outflows as clients seek to spread risk.

UBS reported net profit of $29 billion for the second quarter.

The bumper profit is due to a huge one-off gain that reflects how the acquisition costs were far below Credit Suisse’s value. It was somewhat under a consensus estimate of $33.45 billion from a poll conducted by the bank.

#Banking #giant #UBS #absorb #Credit #Suisses #domestic #bank