Adani offloads 8% stake in power co for Rs 8,700 crore

[ad_1]

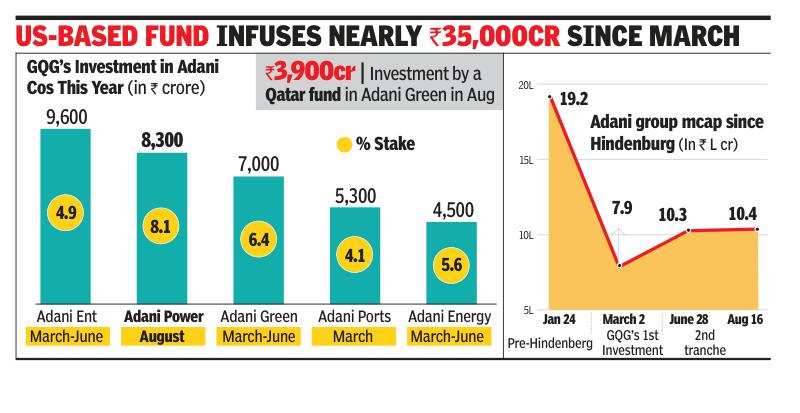

Adani Power is the fifth company of the conglomerate where GQG has invested amid the fallout of Hindenburg’s allegations against the group. GQG, which was co-founded in June 2016 by India-born Rajiv Jain, is on the Australian stock exchange and manages assets worth $92 billion. Apart from Adani Power, it holds shares of Adani Enterprises, Adani Green, Adani Transmission and Adani Ports.

GQG also holds shares of Ambuja Cements but unlike the five stocks, which it largely acquired from the promoter family, it had picked up the building materials company’s shares fromthemarket.

Bulk deal disclosures on the two bourses showed Worldwide Emerging Market Holding sold 1.2% in Adani Power for Rs 1,300 crore while Afro Asia Trade and Investments offloaded its entire 6.9% for Rs 7,400 crore.

The stock was sold at a price similar to its closing price of Rs 279 on the BSE on Wednesday. After the transaction, Worldwide Emerging holds 3.8% of Adani Power, the country’s largest coal-fired electricity generator.

Disclosures also showed that GQG and an affiliate fund bought 15.2 crore shares of Adani Power, representing nearly 4% of the company’s equity, for Rs 4,240 crore. This is GQG’s first investment in Adani Power, but forms part of its larger bet on the Adani Group.

Sources said GQG also picked up the remaining 4.2% stake sold in the secondary market. The deal — one of the largest secondary market trades — witnessed a stock exchange transaction of 31 crore shares, representing 8.1% of Adani Power’s total equity.

Money raised from the stake-sale will be used to shore up liquidity as the family led by Gautam Adani seeks to improve the credit profile of the conglomerate and regain the confidence of investors in the aftermath of Hindenburg Research’s critical report on its business practices.

The group has a consolidated debt of Rs 2.4 lakh crore and a total cash balance of over Rs 37,400 crore.

GQG has also been buying shares of other Indian companies. On Wednesday, it invested Rs 352 crore in Sajjan-Jindal owned JSW Energy by buying 1 crore shares of the company for Rs 342 apiece through secondary transaction, BSE data showed.

#Adani #offloads #stake #power #crore