Why NSE’s unlisted shares have rallied over 20% in off-market transactions

[ad_1]

According to brokers, this rise can be attributed to the increased demand from wealthy individuals and retail investors, coupled with a limited supply of shares.Some large investors have also reneged on their commitment to sell, further driving up the demand, brokers told ET.

The rally in the shares of the two listed exchange operators, the BSE and the Multi Commodity Exchange of India, along with the unlocking of value through the proposed public issue of the National Securities Depository (NSDL), in which NSE holds a 24% stake, have contributed to the surge in prices as well, the brokers explained.

Brokers report that the stock, which was trading at around Rs 3,100-3,200 a month ago, has now reached a range of Rs 3,800-3,900. However, it is important to note that these prices pertain to transactions in the unlisted market and are not official figures.

NSE

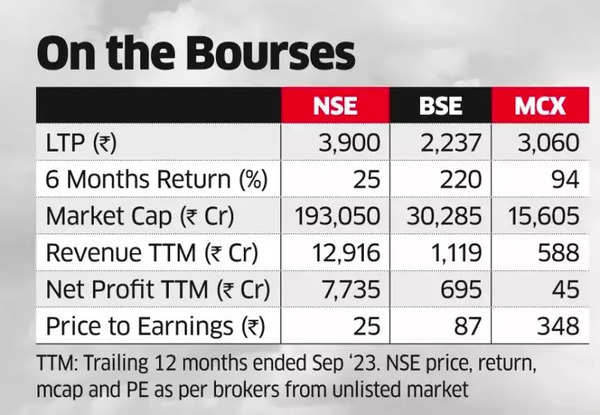

At Rs 3,900 per share, the NSE, India’s largest bourse, would have a valuation of Rs 1.93 lakh crore, or 25 times its 12-month earnings.

In comparison, shares of the BSE have surged by 220% in the past six months, while those of the MCX have gained around 94%. Currently, these two exchanges are trading at 87 times and 348 times their trailing 12-month earnings, respectively.

Sandip Ginodia, the managing director of Abhishek Securities, attributed the sharp increase in NSE’s share price to significant demand from retail investors and the non-fulfillment of selling commitments by a few major investors.

Following a surge from Rs 1,800 in January 2021 to Rs 3,500 in December of the same year, the stock remained stable around Rs 3,000 due to uncertainties surrounding its initial public offering plan. Over the past one to two years, several significant institutional investors have divested part of their holdings. NSE shares with a total value of Rs 1,860 crore were exchanged at an average price of Rs 2,939, in the quarter ended September.

Narottam Dharawat of Mumbai-based Dharawat Securities stated that due to a strong upswing in BSE and MCX stock prices, there is a sudden increase in demand for NSE shares from both high-net-worth individuals (HNIs) and retail investors. The limited supply of shares and the listing of its associate company, NSDL, have also been pivotal factors in driving this surge.

NSDL, India’s largest depository, is expected to launch its maiden public issue in the next few months with a valuation of Rs 11,000-12,000 crore. NSE, currently holding a 24% stake in NSDL, will sell 9% of its shares.

For the six months leading up to September 2023, NSE reported a consolidated revenue growth of 25% to Rs 7,380 crore, along with an 11% increase in net profit to Rs 3,843 crore. The exchange boasts a profit margin of over 50%.

Read From ET | Unlisted NSE shares move up

However, purchasing NSE’s unlisted shares is not an easy task, as the stock exchange has implemented strict compliance measures involving know your customer (KYC), funding source verification, and background checks of investors. Brokers note that NSE takes time to grant approval for such transactions.

#NSEs #unlisted #shares #rallied #offmarket #transactions