Why Indian IT sector giants are likely staring at slowest growth ever

[ad_1]

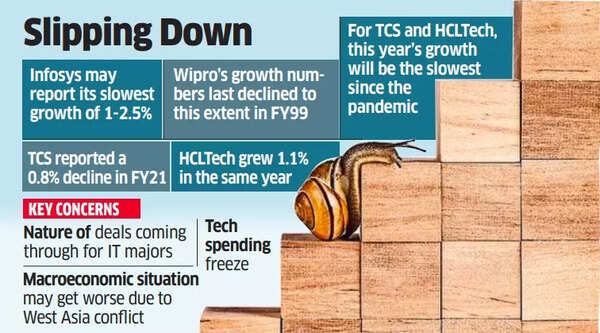

Tata Consultancy Services (TCS), India’s leading software services exporter, and HCLTech, the third-largest IT services provider, are also witnessing their slowest growth since the pandemic. In FY21, TCS reported a 0.8% revenue decline, while HCLTech achieved just 1.1% growth, representing their lowest figures.

The IT industry is facing a freeze on technology spending due to concerns about a recession and a challenging macroeconomic situation, which is expected to worsen due to the West Asia conflict.

Peter Bender-Samuel, CEO of consultancy firm Everest Group, warned that some companies risk posting their worst growth ever in 2024. Bender-Samuel expects the first half of the year to be tough for the industry.

Indian IT growth concerns

According to Peter Bender-Samuel, this is driven by two factors: Firstly, large enterprises need time to absorb the significant investments they made in digital technology following the Covid-19 pandemic. Secondly, the macroeconomic situation is challenging, with a likely recession predicted for next year, which could further exacerbate the pullback experienced this year.

One of the concerns impacting revenue growth is the nature of the deals these companies are securing. While several IT firms have announced deal wins in recent quarters, analysts highlight a disconnect between deal wins and revenue, as well as the quality of revenue. The presence of a larger share of “pass-through” components in deals, where IT vendors take ownership of customer assets or software, is seen as negative for long-term revenue growth, as there is little value addition from the vendor.

According to a Q2 results analysis by JM Financials, Infosys’ normalized growth was only 0.5% during the quarter when excluding higher pass-through revenue and one-time gains. Pass-through revenue refers to one-time income recorded by IT companies.

Ravi Menon, a research analyst at Macquarie Capital, noted that Infosys currently has a larger share of pass-through revenue, 7.3% of revenue, compared to other firms. TCS has only 0.8% of its revenue from pass-through costs, and HCLTech’s pass-through revenue stands at just 1.5%. Menon expects minimal changes in pass-through costs for TCS and HCLTech.

Despite the challenges, Bender-Samuel believes that the underlying momentum of the shift towards digital technology will contribute to a modest bounce back in the third and fourth quarters of 2024 (Q2-Q3 of fiscal 2025). He predicts that the tech services industry will grow at a rate of 2.5-3.5% next year, with a greater emphasis on cost savings rather than new profitable ventures. The large Indian firms should be able to grow slightly faster than the overall market, achieving growth rates of 3-5%, with most of the growth occurring in the second half of the year, he says.

#Indian #sector #giants #staring #slowest #growth