Vodafone Idea, Yes Bank, Coal India among top 10 wealth destroyers on Dalal Street – Rs 5.6 lakh crore destroyed in 5 years

[ad_1]

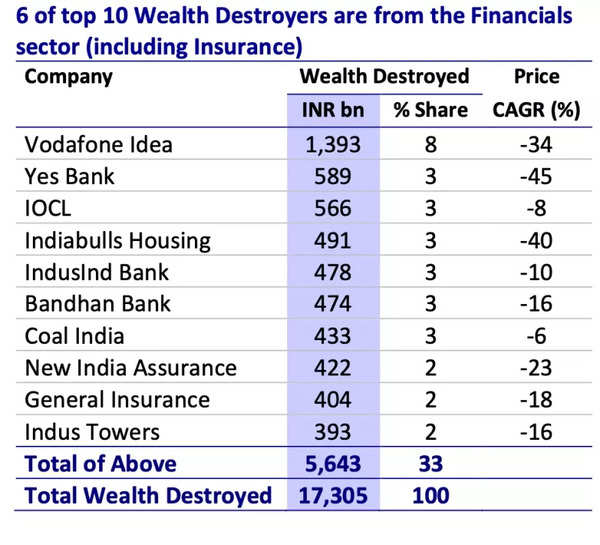

Vodafone Idea’s shares have witnessed a Compound Annual Growth Rate (CAGR) decline of 34%, while the second-largest wealth destroyer, YES Bank, has experienced a CAGR decline of 45%. The private sector lender’s poor show has resulted in a loss of around Rs 58,900 crore over the last five years, according to an ET report.

Top 10 Wealth destroyers

Other notable companies that feature in the top wealth destroyers list include IOCL, Indiabulls Housing, IndusInd Bank, Bandhan Bank, Coal India, New India Assurance, General Insurance, and Indus Towers.

Motilal Oswal’s study reveals that the total wealth destroyed during the 2018-2023 period amounts to Rs 17 trillion, which is 25% of the total wealth created by the top 100 companies. However, this figure remains relatively lower compared to the previous study period of 2015-2020, which was severely impacted by the Covid-19 pandemic.

Interestingly, six out of the top ten wealth-destroying companies belong to the financial sector, including insurance companies. Financials, despite being the top wealth-destroying sector, also ranks as the third largest wealth-creating sector.

Financials among wealth creators and destroyers

On the other hand, the ten biggest wealth creators have accumulated an impressive Rs 37.8 lakh crore. Leading the list of winners are prominent companies such as RIL, TCS, ICICI Bank, Infosys, and Bharti Airtel.

Surprisingly, a lesser-known company, Lloyds Metals, has emerged as the fastest wealth creator, boasting a Compound Annual Growth Rate of 79% from 2018 to 2023. According to Motilal’s report, a mere investment of Rs 10 lakh in the top ten fastest wealth creators in 2018 would have yielded a value of Rs 1 crore by 2023, resulting in a remarkable Compound Annual Growth Rate of 59% compared to the Sensex’s 12%.

#Vodafone #Idea #Bank #Coal #India #among #top #wealth #destroyers #Dalal #Street #lakh #crore #destroyed #years