Tech: It’s BoomGPT time for US tech stocks

[ad_1]

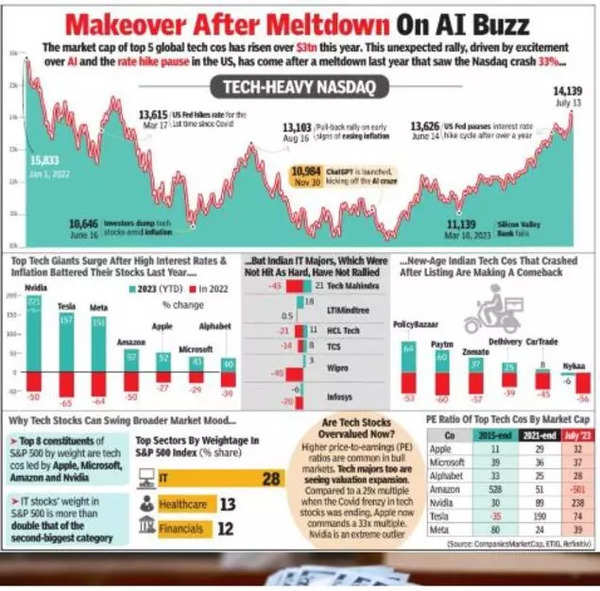

Nvidia, which dominates the market for chips that power artificial intelligence (AI) operations, is not an outlier among US tech giants in terms of stock price (and market cap) gains in 2023, a year that most analysts predicted would be a gloomy one for the tech space.

Every top tech company with AI play has been rewarded by markets. The stock of Microsoft, whose cumulative investment in AI firm OpenAI has reportedly swelled to $13 billion, has jumped 43% yearto-date (YTD) — taking its market cap to nearly $2. 6 trillion. Last month, Apple became the first company to cross the $3 trillion market cap mark.

At $5. 7 trillion, the January-June 2023 period ranks third in terms of US market cap gain, data collated by ETIG showed. The biggest half-yearly market cap gain of $9. 8 trillion was in July-December 2020, followed by $7 trillion in January-June 2021.

The viral success of OpenAI-owned ChatGPT, which uses existing data to create new content from poems to code, kicked off an AI race among global tech giants. Unsurprisingly, Wall Street joined in: The combined market cap of the top 5 US tech companiesrose by over $3 trillion in the first half of the year.

“Over two decades, tech giants laid the foundation for tremendous productivity gains; now, generative AI isbuilding the super-structure for a multi-decade, super-cycle of AI-driven growth,” said Annat Jain, MD, Payard Investments, a New York-based investment firm focused on India. “In this cycle, we’ll see efficiency gains in every industry, and numerous new business models will emerge. The market is responding to that expectation. ”

After the meltdown in2022, the sector is seeing tailwinds this year. Tech giants resorted to brutal layoffs after the pandemic-months’ hiring boom. The lower headcount is now aiding their profits. Another factor supporting the rally is the expected end to interest rate hikes by most major central banks by 2024. Tech companies find higher rates unfavourable as they choke easy money.

The US central bank hit the pause button in June after raising interest rates 10 times since March 2022. Although there are indications that the Fed may raise rates in its meeting later this month, the rate hike cycle is expected to end soon. Some economists say that the US central bank may start cutting rates in 2024, which would again help the tech sector.

According to a former domestic fund manager, another reason for the tech rally is the partial shift of money from Chinese tech stocks — due to regulatory woes that started about three years ago — to the US market as it started showing signs of a rally this year.

So how to spot winners in this rally? “Companies that will make the value shift will be significant beneficiaries. An obvious and early example is Microsoft, whose AI-enabled Office suite will not only add to its revenue but create cascading gains for all its clients down the line,” Jain said.

Indian Investors: In the rally so far this year, have domestic investors also made some money? Yes. Riding on ETFs and feeder funds that track US stocks, indices, and funds, most saw handsome returns. The highest gain among these funds has come in Mirae MF’sNYSE FANG+ ETF, which returned more than 70% in the first half of 2023.

In India, however, the stock prices of home-grown tech majors have not seen any significant gains. TCS and Wipro have gained in single digits on a YTD basis, while Infosys is down about 6%. It’s worth mentioning that in 2022, Indian IT majors were not hit as hard as their American counterparts. TCS had fallen 14%, while Infosys had dropped 20%.

Will there be an Indian version of the tech stock boom? “Indian tech companies have become significant global players over the last two decades. I expect them to create transformative use cases for their clients. A new generation of entrepreneurial disruptors will emerge who will use the large data sets emerging out of India to create innovative global solutions. When evidence of that begins to appear, the US tech rally is bound to be replicated in India,” Jain said.

Some analysts said that the drop in Indian IT majors’ valuations makes them attractive long-term bets. “Higher deal conversion can be expected in the second half of FY24. On the valuation front, over the past 18 months, it has corrected by more than a third, limiting the downside risk,” Vinod T P of Geojit Financial Services said.

Dalal Street will have to wait a while before the Wall Street party reaches it.

#Tech #BoomGPT #time #tech #stocks