TCS share buyback: Retail investors can earn 5%-17% returns over 3 months – math explained

[ad_1]

India’s largest software services exporter has announced a Rs 17,000 crore share buyback, wherein 40.9 million shares will be acquired at Rs 4,150 per share, representing a premium of 17.5% over the Thursday closing price of Rs 3,542. This presents an arbitrage opportunity for investors who can tender their shares in the buyback.

Approximately 6.15 million shares, equivalent to 15% of the buyback, are reserved for small shareholders with holdings valued below Rs 2 lakh on the yet-to-be-announced record date.

TCS share buyback: Expected gains

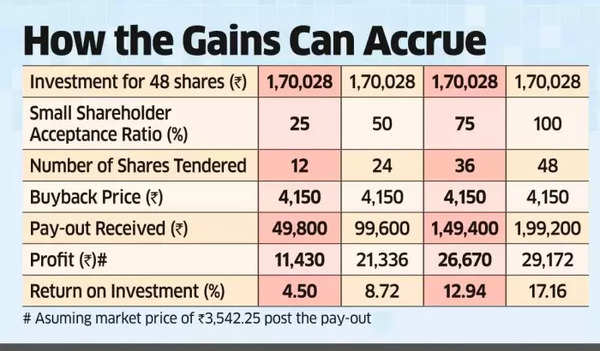

Investor returns will depend on the acceptance ratio, which is the proportion of shares accepted in relation to those tendered. Based on calculations by ET, returns could range from 5% to 17%, with a higher acceptance ratio implying a better return for those who tender their shares.

If the closing value of TCS is at Rs 4,150 on the record date, then a shareholder with 48 shares will be seen as a small shareholder. If there is a 25% acceptance ratio and a market price of Rs 3,542.25 (market closing price on October 12), then it could yield approximate 5% return over the next 90 days.

Indian entrepreneurs to shape future of technology, says MoS IT Rajeev Chandrashekhar

Typically, the buyback process spans around three months, requiring shareholder approval through a postal ballot.

At a 50% acceptance ratio, investors could earn Rs 21,336 on a Rs 1.7 lakh investment, resulting in an 8.72% return. With a 100% acceptance ratio, the profit could reach Rs 29,172, implying a 17% return.

Sriram Velayudhan, VP of Alternative Research at IIFL Securities, described this tender buyback arbitrage as an appealing opportunity for retail investors. However, he noted that the anticipated acceptance ratio may fluctuate due to changes in retail shareholding, and the figures considered would primarily revolve around the buyback’s record date.

In previous TCS buybacks in 2017, 2018, and 2020, the acceptance ratio for retail investors was 100%, but it decreased to around 20% in 2022. Small shareholders held 4.31% of the company’s total paid-up capital as of March 2023. The exact number of eligible shareholders on the record date will be detailed in the forthcoming letter of offer, expected within two weeks after the record date.

Kotak Institutional Equities pointed out that TCS has consistently conducted share buyback programs through the tender route in recent years. The prior buyback was larger at Rs 18,000 crore and occurred at a higher stock price of Rs 4,500 per share.

TCS shares have faced performance challenges in the last couple of years, underperforming the Nifty due to uncertainties surrounding the US and European economies. TCS shares saw a 4% decline compared to the Nifty’s 12% returns in the last two years.

Abhilash Pagaria, Head of Nuvama Alternative & Quantitative Research, noted a decrease in acceptance ratios in recent buybacks due to greater awareness and active participation by retail investors. He anticipated similar acceptance rates in this round, suggesting that exiting shareholders should consider a 20% acceptance expectation.

#TCS #share #buyback #Retail #investors #earn #returns #months #math #explained