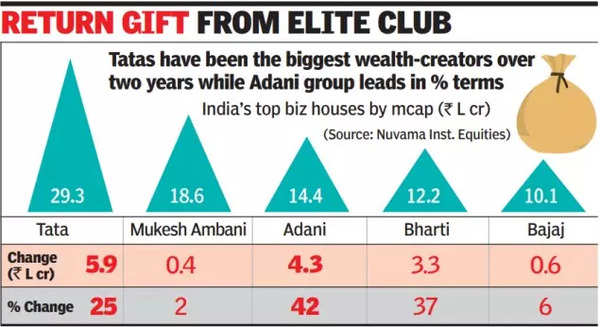

Tatas top wealth creators among India’s business houses

[ad_1]

Next is Adani Group. Its 10 listed companies together added Rs 4.3 lakh crore too investor wealth, a return of 42%. “Despite the Hindenburg saga, Adani Group emerged as a major wealth creator during this period. None of the Adani companies posted negative returns. Adani Power has been the largest wealth generator, with its share price appreciating more than five times,” said Girish Bhise, founder, ValueAdd Research & Analytics Solutions. Sunil Mittal’s Bharti Group has emerged as the third largest wealth creator for investors, followed by the South-based Murugappa Group, while Aditya Birla is in the fifth spot.

Mukesh Ambani’s RIL and Bajaj Group, however, underperformed the sensex, which delivered a return of 16% in the last 2.2 years. Apart from Murugappa, four other groups generated a return of over 100%. Venu Srinivasan’s TVS Group and Ravi Jaipuria Group, with its two listed companies, Varun Beverages and Devyani International, generated a return of 226% and 204%.

Murugappa, with its nine listed companies, cumulatively added Rs 1.8 lakh crore to investor wealth, a return of 119%. CG Power, which Murugappa had acquired in 2020 and which is headed by N Chandrasekaran’s brother N Srinivasan, created the fastest wealth in the last 2.2 years, generating a return of 375%. It added Rs 54,000 crore to investor wealth. Murugappa Group turned around the cash-strapped CG Power, making it debt free and rewarded shareholders with dividends.”There has been considerable wealth creation within some business groups. We expect this bullish phase to continue to deliver consistent long-term gains as Indian equities remain a favourable destination of capital,” said Shiv Sehgal, president, Nuvama Capital Markets.

#Tatas #top #wealth #creators #among #Indias #business #houses