Steep fall! Zee Entertainment shares drop 28.18% following Sony’s merger termination; here’s what experts have advised | India Business News

[ad_1]

As of 12:02 PM, shares of Zee Entertainment were trading 28.18% lower at Rs 166.45 on BSE.

With the merger officially called off, brokerages such as CLSA have swiftly downgraded Zee from a “BUY” to a “SELL,” revising the target price from Rs 300 to Rs 198, according to an ET report. The sector is expected to witness increased competition, especially with the reported merger of Reliance and Disney Star.

Analysts predict that Zee’s near-term valuation will remain subdued due to various factors, including Sony seeking a termination fee, uncertainties about Zee’s new strategy and partners, and the actions of its minority stakeholders.

Nuvama has adjusted its FY25E/26E EPS on Zee, reducing it by 16%/24%, and downgraded the stock to “reduce” with a target price of Rs 190. Elara and Motilal Oswal have also downgraded Zee, setting target prices of Rs 170 and Rs 200, respectively.

Motilal Oswal expressed concerns about the lack of clarity on Zee’s future direction. The company’s recovery in earnings is not expected in the near term, and uncertainties regarding the litigation with Sony further complicate matters, it said.

Facing fierce competition from digital media and the potential threat from the RIL-Disney merger, Zee has reported muted growth and profitability in the past two years. Losses in the OTT segment and lower growth in the linear TV segment have contributed to a dip in the EBITDA margin to 10.7%.

Elara was quoted saying that the possibility of Zee’s target price falling to as low as Rs 130 if the company honors its contract with Disney for the sub-franchise of ICC tournaments on linear TV. The broadcasting business and OTT segment were valued at 10x one-year forward P/E and 3.0x one-year forward EV/sales, respectively, Elara said.

In a shifting industry landscape towards OTT, Zee5 is perceived to be on weak footing, competing against strong players like Disney, Netflix, Amazon Prime, and Network18 led by Reliance Industries. Amidst the turmoil, Sony is seeking a termination fee of $90 million from Zee, leading to a legal dispute as Zee refutes the claims and plans to contest them in arbitration proceedings.

Experts advise avoiding Zee shares – here’s why

Analysts have warned against buying shares in the hopes of the price bottoming out during the current market downturn, following the failed merger with Sony. This merger was seen as a potential lifeline for Zee, which is grappling with ongoing crises and a decline in market share.

In the last month, Zee’s stock has dropped by 15%, contrasting with the 1% gain in the Nifty index, primarily due to uncertainties related to the unsuccessful merger. After the deal announcement in December 2021, Zee shares had surged from around Rs 170 to about Rs 370.

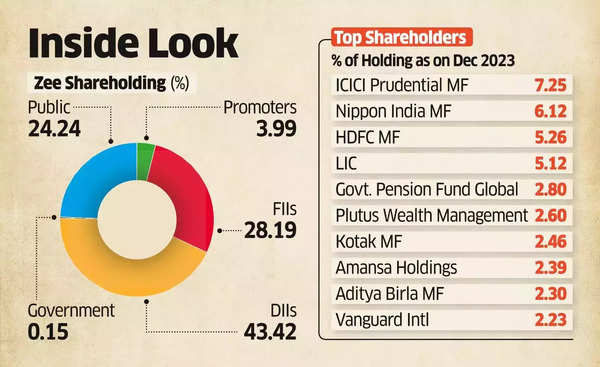

As of December 2023, foreign institutional investors held 28.19% of the company, domestic institutional investors held 43.42%, and retail investors had 24.24%. Notable shareholders, such as ICICI Prudential, Nippon India, and HDFC MF, owned stakes ranging from 5.26% to 7.25%, and Life Insurance Corporation of India held 5.12%.

The failure of the merger has broader implications, as it was considered advantageous for both Zee and Sony, particularly in light of industry dynamics following the Disney-Viacom merger. Zee may face near-term downgrades, affecting both shareholders and its overall position.

Corporate governance firms attribute the deal breakdown to the promoters and the board. Shriram Subramanian, Founder and Managing Director of InGovern Research Services, points out that frustrated public shareholders have the right to hold the board accountable. Shareholders may seek change by calling an Extraordinary General Meeting (EGM) to address concerns.

Recent reports indicate that institutional investors, including Life Insurance Corporation, have written to the Securities and Exchange Board of India, expressing concerns about the stalemate in the merger talks with the Sony Group adversely affecting minority shareholders.

#Steep #fall #Zee #Entertainment #shares #drop #Sonys #merger #termination #heres #experts #advised #India #Business #News