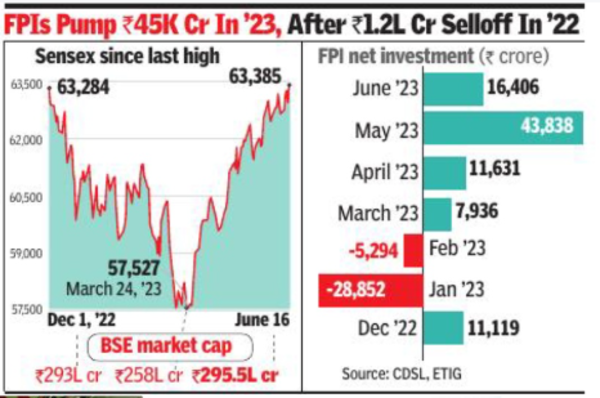

Sensex ends at record high of 63,385 points on Wall Street rally

[ad_1]

The S&P 500 and Nasdaq on Thursday surged to close at their highest in 14 months, as investors cheered economic data that fuelled bets that the US Federal Reserve is nearing the end of its aggressive interest rate hike campaign, Reuters reported. The S&P 500 also recorded 24 new 52-week highs and no new lows, while the Nasdaq recorded 90 new highs and 36 new lows, it added In addition to the US market rally, domestic factors like falling inflation rate, robust tax collection numbers, a stable rupee and strong foreign fund buying have been helping the market rally in recent weeks, brokers and analysts said.

However, the widening of the trade deficit for April at over $20 billion was a damper, they said. Since May 1, foreign portfolio investors (FPIs) have net bought stocks worth about Rs 60,000 crore, CDSL data showed.

During Friday’s session, most index heavyweights like the HDFC twins, RIL, ITC and ICICI Bank, contributed to the day’s gain, BSE data showed. On the NSE too, the Nifty gained 138 points to 18,826 while the day’s high was 18,865, just 23 points off its all-time peak of 18,888. The domestic market rebounded with strong buying in banking, pharma and consumer stocks, along with positive cues from global markets, Vinod Nair of Geojit Financial Services said. “The US market’s optimism was bolstered by better-than-expected retail sales, reflecting the robustness of the economy. Furthermore, jobless claims remain elevated and a decline in import prices raised hopes for a prolonged pause in interest rate hikes by the US Fed, contradicting their announcement of potential future rate hikes made the previous day. ”

The day’s rally also made investors richer by Rs 2 lakh crore over Thursday with BSE’s market capitalisation now at Rs 295. 5 lakh crore. This is a new all-time high for the BSE’s market cap.

Bloomberg reported that investors are assessing if India could be the next China as emerging market investment choices have become challenging. India is “bridging the gap” with China which is facing “rising scrutiny over slowing growth”, it quoted analysts as saying. “While India is where China was in 2007 on many economic metrics such as size of the economy and per capita GDP, its equities have steadily outperformed China and emerging markets for both over the long and near term,” the report said.

Domestic brokers too have been speaking on the matter, more so after the recent data showed that China’s growth prospects, which was expected to take off since its economy opened up, have been muted.

#Sensex #ends #record #high #points #Wall #Street #rally