Business

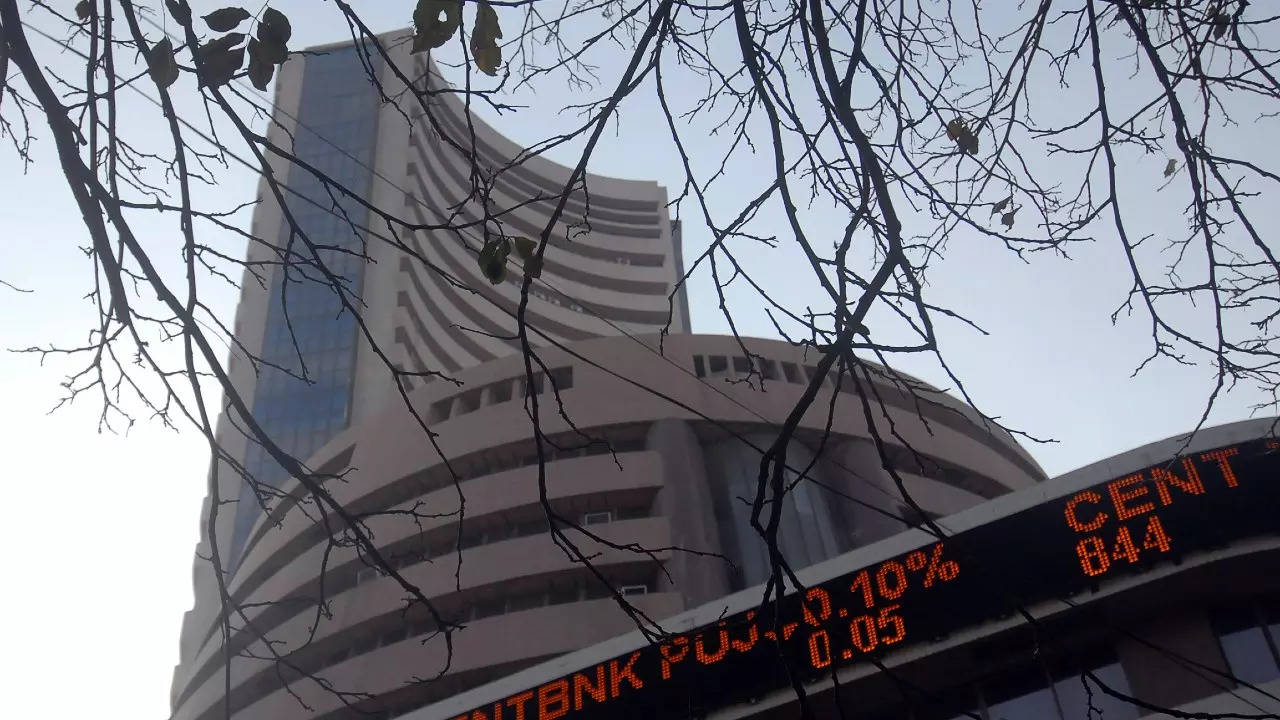

Sensex drops 571 points as US Federal Reserve remains hawkish

[ad_1]

MUMBAI: The US central bank’s hawkish stance on rates left investors jittery as prospects of future rate hikes rose, pulling the sensex down by 571 points on Thursday to 66,230. In three sessions, the index haslost about 1,600 points after gaining over 3,000 points in 11 consecutive sessions.

On NSE, the Nifty lost 159 points to close at 19,742.

On Wednesday night, after the US Federal Reserve’s rate setting committee let the interest rates be unchanged, chairman Jerome Powell left the door open for further rate hikes if the relevant data supports such a move. This unnerved global investors who sold risky assets that included equities.

In the Indian market, rising crude oil prices, weakness of the rupee and an almost unabated selling by foreign investors also weighed on investor sentiment, market players said.

According to Siddhartha Khemka, head, retail research, Motilal Oswal Financial Services, domestic markets slid for the third consecutive day after the US Fed‘s hawkish stance in its policy meeting. “Uncertain global cues and persistent selling by FIIs are likely to keep markets under pressure in the near term,” Khemka said.

So far in the month, foreign portfolio investors have net sold stocks worth about Rs 11,300 crore, after remaining net buyers for six consecutive months since March this year, CDSL and BSE data showed.

SJVN stock crashes 13% as OFs weighs:

The stock price of power producer SJVN crashed 13% in Thursday’s weak market as the government decision to divest nearly 5% stake in the company, through an offer for sale (OFS) left investors concerned about excessive supply of these shares in the market. The stock on BSE closed at Rs 71. The government is eyeing to mobilise about Rs 1,334 crore through this divestment.

On NSE, the Nifty lost 159 points to close at 19,742.

On Wednesday night, after the US Federal Reserve’s rate setting committee let the interest rates be unchanged, chairman Jerome Powell left the door open for further rate hikes if the relevant data supports such a move. This unnerved global investors who sold risky assets that included equities.

In the Indian market, rising crude oil prices, weakness of the rupee and an almost unabated selling by foreign investors also weighed on investor sentiment, market players said.

According to Siddhartha Khemka, head, retail research, Motilal Oswal Financial Services, domestic markets slid for the third consecutive day after the US Fed‘s hawkish stance in its policy meeting. “Uncertain global cues and persistent selling by FIIs are likely to keep markets under pressure in the near term,” Khemka said.

So far in the month, foreign portfolio investors have net sold stocks worth about Rs 11,300 crore, after remaining net buyers for six consecutive months since March this year, CDSL and BSE data showed.

SJVN stock crashes 13% as OFs weighs:

The stock price of power producer SJVN crashed 13% in Thursday’s weak market as the government decision to divest nearly 5% stake in the company, through an offer for sale (OFS) left investors concerned about excessive supply of these shares in the market. The stock on BSE closed at Rs 71. The government is eyeing to mobilise about Rs 1,334 crore through this divestment.

#Sensex #drops #points #Federal #Reserve #remains #hawkish