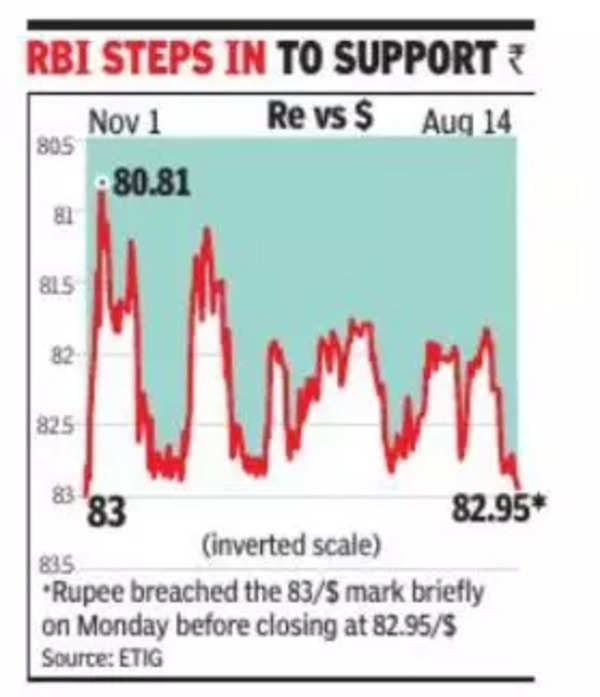

Rupee slips below 83/$ intraday, hits 9-month low

[ad_1]

The rupee closed at 82.95 against the dollar, 11 paise down from Friday. The domestic unit, however, continued to be under pressure and was traded at 83.11/$ in post-market trade. The rupee had hit an all-time low of 83.29 against the dollar in October 2022 due to rising commodity prices and backto-back rate hikes by central banks in advanced economies. “Downward pressure on the rupee will continue for at least a couple of months, but the RBI is keenly watching and selling dollars to arrest any sharp fall in the rupee. The depreciation is mainly attributed to dollar strengthening on account of the economic slowdown in China,” said Hariprasad M P, executive director and business head, Ebixcash World Money. He added that the rupee will likely trade in the range of 81.9-83.1 in the short term with mild to moderate volatility.

While the market directionally expects the rupee to weaken because of a strong dollar, there is no pressure on the external front as the current account deficit is in control and foreign capital flows to India have been quite strong. Last month, RBI had purchased the US currency in the forex market to prevent the rupee from appreciating and to build up its dollar reserves. The key reason for expecting the rupee to depreciate is that RBI might want the local currency to move in tandem with its Asian peers as the dollar gains strength.

The dollar has gained as recent data led to believe that the Federal Reserve is not done with its rate hikes.

#Rupee #slips #intraday #hits #9month