Rajiv Jain: Star investor Rajiv Jain bets $1.9 billion on embattled Gautam Adani empire

[ad_1]

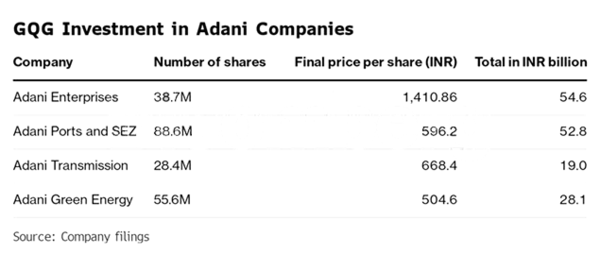

Rajiv Jain’s GQG Partners bought shares in four firms from an Adani family trust at discounts to Thursday’s closing prices, according to a statement from Adani Group and exchange filings. Jefferies brokered the deal.

Jain’s investment comes as a vote of confidence at a crucial time for the beleaguered group, which has spent the past few weeks trying to repair an image damaged by Hindenburg Research’s accusations of accounting fraud and share-price manipulation. After repeatedly denying those allegations, Adani has tried to assure bondholders and has even pared aggressive growth targets to help assuage investor concerns.

“It is surprising, but they have come to a conclusion that this is a good investment opportunity, which many others may not have tried to analyze or decipher,” said Deepak Jasani, head of retail research at HDFC Securities Ltd. “They may be seeing a lot of value at these depressed valuations. They may be looking to deploy large sums in India and have snapped up this opportunity.”

Adani is a bold wager for GQG Chairman Jain, who’s known to broadly prefer safe, defensive stocks of companies that have what he calls bullet-proof balance sheets.

Born and raised in India, Jain made his name as a star emerging markets fund manager at Swiss firm Vontobel Asset Management. Later he co-founded GQG and built it into a $88 billion powerhouse with investments in industries like oil, tobacco and banking. In 2022, when most asset managers watched clients yank cash from their funds as markets cratered, Florida-based GQG thrived. The firm lured $8 billion in fresh investment and three of its four flagship funds beat benchmark indexes by wide margins.

In an interview Thursday after the investment announcement, Jain said that he first looked at billionaire Adani’s ports-to-energy empire more than five years ago, but that until recently the shares weren’t enough of a “bargain” to take a position.

After Hindenburg’s January 24 report called the conglomerate’s meteoric rise as the “largest con in corporate history,” nearly two thirds of its market capitalization evaporated, with losses reaching as much as $153 billion before a slight rebound this week.

Adani Total Gas Ltd has been hurt the most among the 10 group stocks in the rout, plunging more than 80%. Flagship Adani Enterprises Ltd.’s shares have lost half of their value.

Valuations for the group have similarly slumped. Adani Enterprises is trading at less than half of its 12-month forward earnings, while multiples for Adani Transmission Ltd. and Adani Green Energy Ltd. are down by more than two-thirds.

“What is missing here, what nobody talked about, was these are phenomenal, irreplaceable assets,” Jain said. “You have to be greedy when people are fearful. Whenever there are parties going on, we stand on the sidelines watching people dance most of the time.”

GQG bought shares of Adani Ports and Special Economic Zone Ltd. — considered the group’s crown jewel — at a 4.2% discount to Thursday’s close, resulting in a 4% stake. It bought Adani Green Energy and Adani Transmission at a 5.7% discount for stakes of 3.5% and 2.5%, respectively, and Adani Enterprises at a 12.2% discount for a 3.3% stake.

The least surprising of GQG’s bets is probably Adani Ports, which has been touted by investors for its strong operations. The stock is the most well covered of the group outside of its cement-related acquisitions, with a buy rating from all 21 analysts tracked by Bloomberg.

Analysts at JM Financial Ltd. expect Adani Ports to generate 140 billion rupees ($1.7 billion) of free cash flow, which they say is substantially higher than its projected debt-repayment obligations of about 110 billion rupees over the 2024 and 2025 fiscal years.

Jain said his team met with Adani management last summer, and that he sees the investment helping advance India’s economy and energy infrastructure, including energy transition goals.

Regulated assets

In a February 23 interview with Bloomberg TV, Jain said that while Adani’s implosion didn’t change his view on India as a whole — where GQG is overweight — “Adani, specifically, is a different call to make.”

“These are regulated assets” unlike Enron, he said, adding India’s “banking system is fine.”

While GQG’s investment should help provide “tactical support” to the battered Adani stocks, investors will wait for the conclusion of a court-ordered probe into Hindenburg’s allegations against Adani, said Nitin Chanduka, a strategist at Bloomberg Intelligence in Singapore.

India’s Supreme Court on Thursday set up a six-member panel to investigate the bombshell report. It also asked the Securities and Exchange Board of India to look into any manipulation of Adani stocks and report its findings within two months.

The Adani Group said it welcomed the order, and that it will “bring finality in a time-bound manner.”

Desperate to sell

The support from GQG could stem further declines in the near term, but the discounts also show the seller was desperate, said Abhay Agarwal, fund manager at Piper Serica Advisors.

When asked if the Adani trust was desperate to sell, Jain disputed the characterization, noting that some of the stocks have rallied more than 30% from recent lows.

Jain is confident in the conglomerate and said GQG’s “edge” is understanding better than others how utilities operate.

He pointed out that Adani Enterprises has generated returns of about 30% a year in dollar terms since it was listed in 1994, outperforming some of the best-known companies in the world.

“What would you say that company is?” Jain said. “I’m just stating you don’t have frauds lasting 30 years, generally.”

#Rajiv #Jain #Star #investor #Rajiv #Jain #bets #billion #embattled #Gautam #Adani #empire