Pulkit Samrat: Special drive sees GST evasion of Rs 1.5 lakh crore till October

[ad_1]

Separately, minister of state for finance Pankaj Chaudhary told Rajya Sabha that in the current and last financial year, authorities had issued 71 show cause notices to online gaming companies, involving Rs 1,12,332 crore.

Tax authorities had stepped up notices after the GST Council decided to “clarify” that online gaming and casinos faced a 28% levy on the gross betting amount. The government is hoping to collect taxes from these companies, although the demand is yet to be determined.

The matter is, however, in courts as some of the gaming companies have challenged the government action.

Data shared by the finance ministry showed that of the evasion of over Rs 1.5 lakh crore detected so far this year, recovery has been made to the tune of Rs 18,541 crore and 154 persons have been arrested up to October, as against 190 in FY23.

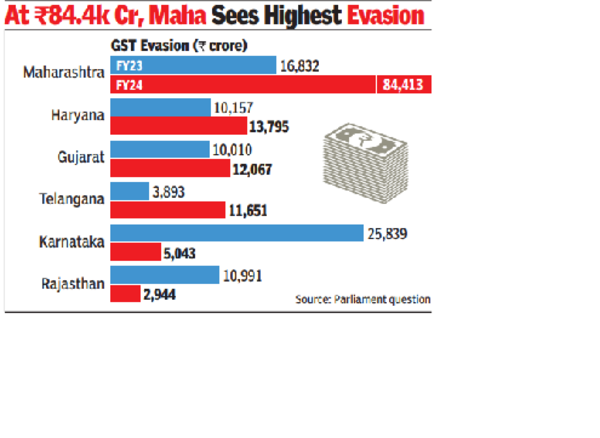

Maharashtra, which is home to the largest number of businesses and taxpayers, has also seen the highest amount of evasion, estimated at Rs 84,400 crore, which is 56% of all-India amount. The Centre and the states have stepped up action against fraudsters, who were claiming input tax credit based on bogus invoices and forged registration.

So far this year, Maharashtra is way ahead of others in terms of recovery, having managed to get back over Rs 4,100 crore. But last year, it just managed to stay ahead of Rajasthan, which reported recoveries of Rs 6,515 crore, as against Maharashtra’s 6,587 crore, the finance ministry said, while responding to a question by BJP MP Sushil Kumar Modi.

#Pulkit #Samrat #Special #drive #sees #GST #evasion #lakh #crore #October