Promoters clear dues to avoid insolvency

[ad_1]

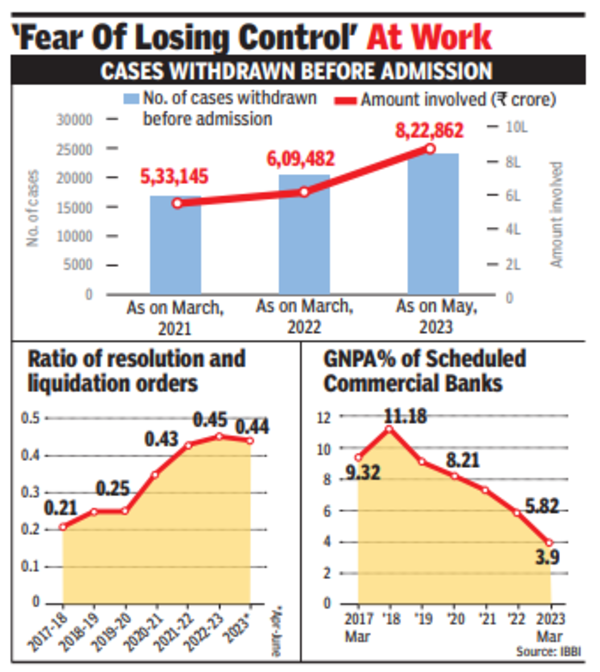

At 25,565, the number of cases closed before admission in NCLT benches is 3.7 times higher than the number of cases that are admitted (6,811), which results in the appointment of a resolution professional and committee of creditors, and ouster of promoters.

Since the law came into force towards the end of 2016, the “default amount” or the amount settled is estimated at over Rs 8.2 lakh crore (up to May 2023), while the amount recovered from 720 cases (up to June) that were resolved through the NCLT process was pegged at Rs 2.9 lakh crore, against claims of Rs 9.2 lakh crore, latest data released by the Insolvency & Bankruptcy Board of India (IBBI) showed.

Even after admission, around 1,900 cases saw a closure because of withdrawal, through appeals and reviews, or settlement.

“A distressed asset has a life cycle. Its value gradually declines with time if distress is not addressed. The credible threat of the code, that a corporate debtor may change hands, has changed the behaviour of debtors. Thousands of debtors are resolving distress in the early stages. They are resolving when default is imminent, on receipt of notice of repayment but before filing an application, after filing application but before its admission, and even after the admission of application, making best efforts to avoid consequences of the resolution process. Most companies are rescued at these stages,” IBBI said.

Many cases where the default was settled before the admission stage are from operational creditors, who have smaller dues compared to banks. Since the default amount is smaller, promoters often resort to clearing the dues, some of which may have been pending for years. Around 80% of the corporate insolvency resolution cases, with a default of under Rs 1 crore, were triggered by the operational creditors. In cases involving defaults of over Rs 10 crore, the situation was just the reverse as 80% of cases were initiated by financial creditors, which means banks and financial institutions or homebuyers in case of real estate. Among 6,811 cases admitted by NCLT up to June 2023, operational creditors triggered 49.5% or 3,369 cases, 44.6% was by financial creditors, with the rest coming from the corporate debtor or the company.

#Promoters #clear #dues #avoid #insolvency