Paytm to delink from Payments Bank, will partner with others

[ad_1]

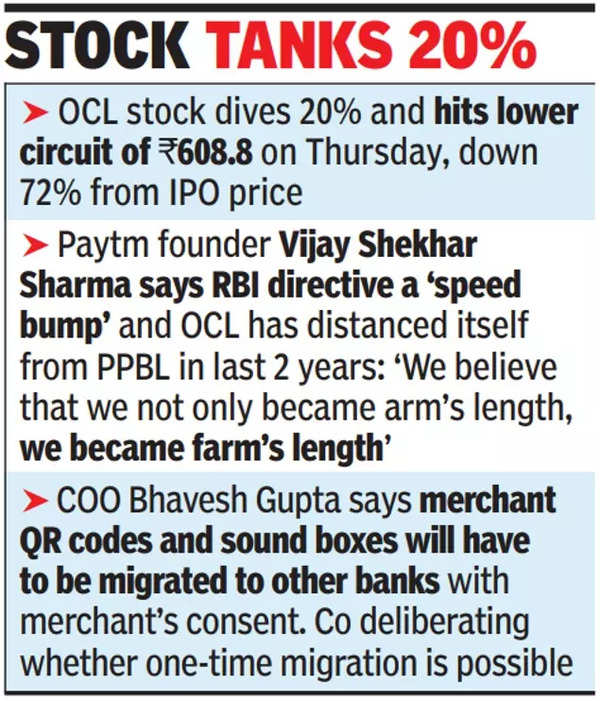

Addressing analysts, Paytm founder and OCL CEO Vijay Shekhar Sharma said the development was a “speed bump” and the company will tide over the crisis. This was even as the company said it would have to halt loan distribution for two weeks and figure out how to transition merchant QR code accounts from PPBL to other banks. On Wednesday, RBI barred PPBL from adding funds to any customer accounts, ending the utility of most of its services with effect from March 1.

Sharma said OCL has distanced itself from PPBL in the last two years since RBI’s ban on PPBL onboarding new customers. “We believe that we not only became arm’s length, we became farm’s length… we rather have a much stronger gap of no data sharing, no data knowledge with PPBL,” said Sharma. Bhavesh Gupta, president and COO, said merchant QR codes and sound boxes currently linked to PPBL accounts will have to be migrated to other banks with the merchant’s consent. The company is mulling whether a one-time migration is possible.

Rivals will seize moment, gain market share: Paytm investors

Such a migration occurred in 2020 when PhonePe had to switch banks overnight after Yes Bank was placed under a moratorium.

“The QR code has a VPA (virtual payment address) of Paytm Payments Bank. We have to change to another bank. This will be a large exercise,” said Gupta, adding that the firm is in discussions with several banks and the regulator. He said the app would sell Fastag of other banks.

OCL stock hit the lower circuit of Rs 609 on Thursday, down 72% from the IPO price. The company said PPBL is taking steps to comply with RBI’s directions and is working with the banking regulator to address concerns. The firm’s worst-case impact due to the measures would be Rs 300-500 crore on its ebitda, it said. “There would be 10-15% odd merchants with loans who would have their repayment through Paytm Payments Bank account. We have to move their settlement account to other banks there,” Gupta said.

On the order to terminate the nodal account of OCL and Paytm Payments Services (PPSL) by February 29, OCL and PPSL will move the account to other banks during this period.

Startup investors said rivals will leverage this opportunity to increase their market share.

#Paytm #delink #Payments #Bank #partner