Oral care cos divided over growth of naturals

[ad_1]

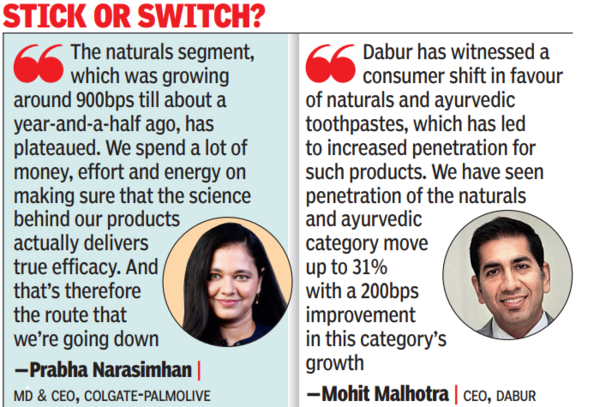

In her first media interaction, Prabha Narasimhan, MD & CEO, Colgate-Palmolive, said the naturals segment, which was growing around 900 basis points (100bps = 1 percentage point) till about a year-and-a-half ago, has plateaued. The oral care leader is now shaping its strategies based on ‘benefits’ that consumers seek under the larger bracket of ‘family health’. These benefits, said Narasimhan, can be delivered either through ‘natural’ i.e. ayurveda or through science. “Our strength lies in delivering these benefits through science,” she said. “We spend a lot of money, effort and energy on making sure that the science behind our products actually delivers true efficacy. And that’s therefore the route that we’re going down,” said Narasimhan.

Dabur CEO Mohit Malhotra, however, said the company has witnessed a consumer shift in favour of naturals and ayurvedic toothpastes, which has led to increased penetration for such products. “We have seen penetration of the naturals and ayurvedic category move up to 31% with a 200bps improvement in this category’s growth,” he said. Dabur’s oral care penetration has increased to 51%, which is every second household, he added.

A third of the Rs 10,000 crore oral care market sits in the naturals segment. Narasimhan said, “Currently, 30% of the benefits that are bought in oral care have a reason to believe that it is natural. That is utterly fungible because consumers buy benefits.” The consumer, she said, would switch a product/brand based on the delivery of the benefit.

Dabur said its oral care portfolio grew by 13% in the first quarter of the year, leading to a strong double-digit 4-year CAGR. “Dabur Red gained 50bps market share in the category, consolidating our position as the number two player. We have expanded our toothpaste portfolio with the launch of Dabur Bae Fresh Gel, which will be a gel toothpaste,” said Malhotra.

Colgate-Palmolive had, in response to competition posed by Patanjali’s entry into oral care, launched its own naturals brand. The American multinational had also created a branded ‘oil pulling’ segment two years ago, which was followed close on the heels by Dabur, which also entered this segment.

#Oral #care #cos #divided #growth #naturals