New debt mutual fund tax rule may help banks bridge deposit shortfall

[ad_1]

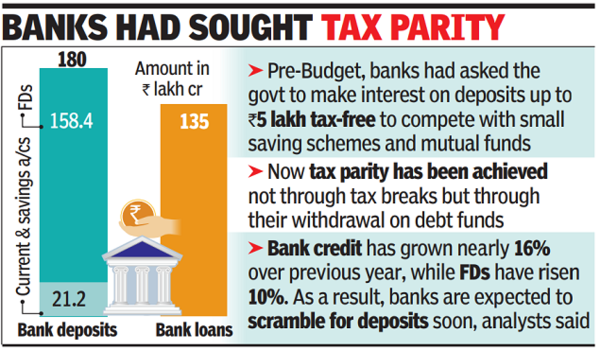

Bank have deposits around Rs 180 lakh crore of which Rs 158 lakh crore are fixed deposits. Debt mutual fund schemes have assets under management of Rs 15 lakh crore and has been rising. While the returns in debt funds have been in line with FDs they have had multiple tax benefits. Unlike bank FDs, mutual funds are taxed on maturity, get indexation benefits and are taxed at a lower rate.

Before the 2023 budget banks had made a representation to the finance ministry asking for interest on deposits up to Rs 5 lakh to be made tax free so that these instruments could compete with small saving schemes and mutual funds.

During the current financial year banks have been struggling with deposit growth which has lagged credit growth. Until March 10, bank deposits grew by 10% or Rs 16.8 lakh crore while credit has grown 15% to Rs 18.4 lakh crore. Banks have managed to fund the Rs 1.6 lakh crore wedge between credit growth and deposits by selling their government bonds, but this was only a temporary solution.

“The latest tax proposals will remove the advantage Debt MFs have over Bank FD and end the tax arbitrage that existed. So, some retail investors will move money to bank FDs. Again, positive for deposits,” said Suresh Ganapathy, associate director, equity research at Macquarie Capital.

According to Ganapathy the current loan to deposit ratio of 75% is above the historical average which means that there could be a scramble for deposits going ahead. “We believe the pressure to raise resources to fund credit growth will remain, thereby keeping a check on deposit rates in our view,” said Ganapathy.

The downside for banks if money moves away from debt mutual funds is that they will now have to find new investors to buy their subordinated debt and additional tier I bonds which help improve their capital adequacy. So far debt funds have been the primary investors in these instruments.

Also, in the case of projects, corporates may find it difficult to find long-term investors in their bonds, a role which was performed by mutual funds. This would increase the pressure on the banks to make up for the absence of debt mutual funds.

#debt #mutual #fund #tax #rule #banks #bridge #deposit #shortfall