MRF Share Price: In a first for an Indian stock, MRF crosses Rs 1 lakh mark; up 600% in 10 years | India Business News

[ad_1]

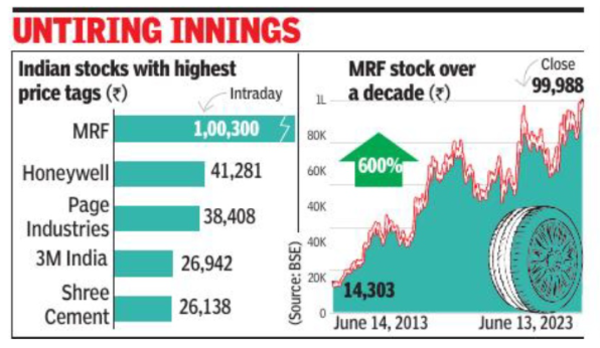

Chennai-based tyre maker MRF on Tuesday passed a new Dalal Street milestone as it became the first stock to cross the Rs 1-lakh-price mark. Its shares hit a 52-week intraday high of Rs 1,00,300 on Tuesday as the stock rose nearly 2%, ending the day at Rs 99,988 on the BSE.

Tendulkar, and other cricketers like Virat Kohli, had endorsed the MRF brand for over a decade. In mid-June of the year when Sachin Tendulkar retired, the MRF stock was trading at around Rs 14,300. Now, it’s worth Rs 1 lakh today.

Not splitting stock key to MRF’s high-priced shares

Does this make MRF the most valuable stock? Not really. Analysts said a high price tag is not necessarily an indicator of how valuable or strong a company’s stock is. Market capitalisation, price-to-earnings (P/E) ratio, profit and other business metrics must be taken into account, they said.

For instance, MRF, with a market cap of Rs 42,390 crore, does not feature among the top companies in terms of valuation. This list is led by RIL with a market cap of over Rs 17 lakh crore, followed by TCS with just under Rs 12 lakh crore. On Tuesday, Reliance’s stock closed at Rs 2,520, while TCS shares ended at Rs 3,244 apiece.

Moreover, how did the MRF stock scale this peak? While companies often undertake stock splits or bonuses to make their shares more accessible to retail investors, MRF has not done so in nearly 50 years. This resulted in the high price tag for its shares.

An analyst said that companies that plan to keep their shareholding more institutional typically do not opt for stock splits. In MRF, retail investor shareholding (up to Rs 2 lakh) stood at 12.7%. MRF did not respond to a request for comments.

“A high-priced share does not necessarily signify that a company is doing very well, just like a low-priced share does not necessarily mean the company is down in the dumps,” Pranav Haldea, MD of Prime Database, said. “What investors instead need to focus on-whether for stock or mutual fund investments-is the future growth potential,” he added.

At Rs 23,008 crore, MRF’s consolidated revenue for 2022-23 grew 19% year-on-year. Profits grew 15% in the same period to Rs 768 crore. Analysts at Motilal Oswal Securities said that MRF’s competitive position is weakening amid peers in the industry.

Watch MRF creates history, share price hits Rs 1 lakh

#MRF #Share #Price #Indian #stock #MRF #crosses #lakh #mark #years #India #Business #News