Missed the stock market rally? There’s good news for investors – lower levels to give buy opportunities

[ad_1]

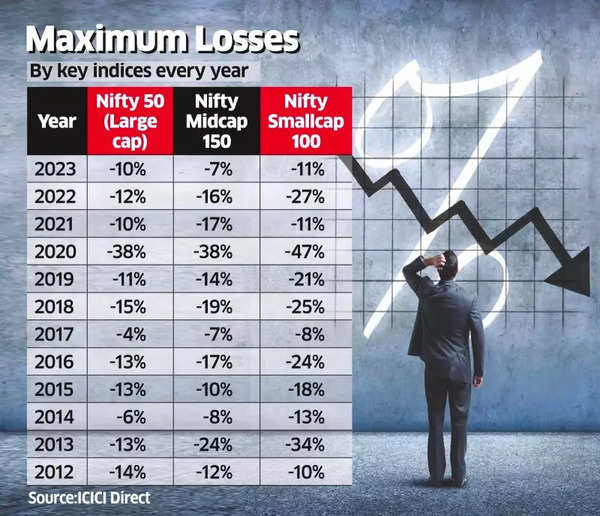

A recent study by ICICI Direct quoted by ET on index declines over the past 12 years revealed that the Nifty fell between 10% and 16% almost every year, except for the significant 38% drop in 2020. When it comes to mid-cap and small-cap stocks, they have experienced declines in each of the past 12 years. The study showed that the Midcap 150 index fell between 10% and 24% on eight occasions, excluding the 38% decrease in 2020.

The declines in small-cap stocks have been even more pronounced. In the 12-year period under review, the Smallcap 100 index slumped between 10% and 34% on 10 occasions, with a drastic 47% plunge in 2020.

Maximum losses by indices

Fund managers have highlighted that the recent modest and brief declines in mid-cap and small-cap stocks have made them more susceptible to steeper corrections.

Harsha Upadhyaya, the chief investment officer at Kotak AMC points out that smallcaps and midcaps have experienced a mostly upward trend in the past three years without any significant corrections. This indicates that volatility in this segment will be higher with moderate returns, he says.

In 2023, Indian equity markets continued their winning streak for the eighth consecutive year, with the Nifty gaining 20%. The Nifty Midcap 150 saw a rise of approximately 44%, while the Smallcap 100 experienced a remarkable increase of 56% during the same year.

Pankaj Pandey, the head of research at ICICI Securities, shared his insights, stating that the risk-reward ratio is more favorable in large-cap stocks compared to small-cap and mid-cap stocks after their sharp rally. However, small-caps and mid-caps are expected to perform better over the next 4-5 years, he said.

Read From ET |Market rally trends in last few years

Upadhyaya emphasized the importance of monitoring earnings growth, but also noted that reasonable returns can be expected with volatility. “Small-caps and mid-caps are currently trading at premium valuations, well above historical averages,” added Upadhyaya.

#Missed #stock #market #rally #good #news #investors #levels #give #buy #opportunities