Low risks for lenders, for now: Moody’s, Fitch

[ad_1]

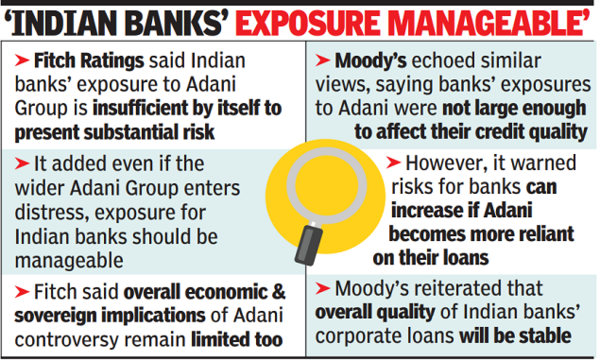

According to Moody’s, the exposure of banks to Adani group is less than 1% of their total loans. While public sector banks have a greater exposure compared to private peers, for most banks, it is less than 1% of their loans. “The group’s access to funding from international markets can be curtailed because of heightened risk perception. In that case, domestic banks may become the main source of funding for the group, resulting in increases in banks’ exposures to Adani and greater risks for them,” said Moody’s.

Rating agencies are taking comfort from two factors – the loans are well distributed across all banks. This ensures that each bank has enough earnings or capital to make good any losses should they have a problem with the loans. Second, the group companies have strong assets and good cashflows, which would mean that there is enough value in the business even if the promoter is in trouble.

“We believe loans to all Adani group entities generally account for 0.8%-1.2% of total lending for Fitch-rated Indian banks, equivalent to 7%-13% of total equity. Even in a distress scenario, it is unlikely that all of this exposure would be written down, as much of it is tied to performing projects. Loans involving projects still under construction and those at the company level could be more vulnerable,” said Fitch Ratings in a statement today.

According to Fitch, there is a risk that public sector banks could face pressure to provide refinancing for Adani entities if foreign banks scale back their exposure or investor appetite for the group’s debt weakens in global markets. “This could affect our assessment of the risk appetite of such banks, particularly if not matched with commensurate building of capital buffers. However, such a scenario would underpin the quasi-policy role of state-owned banks and reinforce our sovereign support expectations,” said Fitch Ratings.

The short-selling in Adani stocks by Hindenburg, which released a report with accusations against the group, has set off a cycle of challenges for the group. The rout in the share prices scared international bond investors who sold their holdings, resulting in a fall in bond prices. The negative sentiment in the bond market has drawn the attention of credit rating agencies which fear that the drying up of funds could spoil the company’s credit profile. The group has tried to break this cycle of negative sentiment leading to negative action by pre-paying some debt.

#risks #lenders #Moodys #Fitch