Loan: RBI cracks down on alternative investment funds misuse

[ad_1]

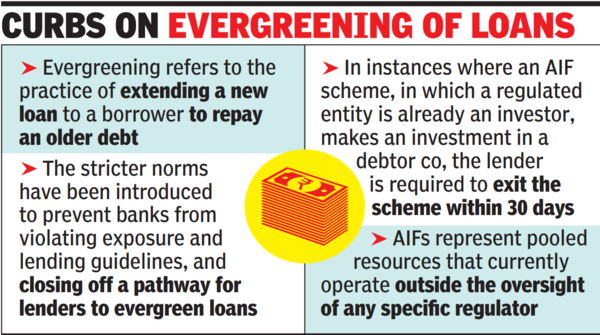

The stricter norms for banks, NBFCs and other regulated entities have been introduced to prevent banks from violating exposure and lending norms, as well as closing off a pathway for lenders to evergreen loans.

Evergreening refers to the practice of extending a new loan to a borrower to repay an older debt. AIFs represent pooled resources that currently operate outside the oversight of any specific regulator.

In instances where an AIF scheme, in which a regulated entity is already an investor, makes an investment in a debtor company, the lender is required to exit the scheme within 30 days. If lenders are unable to liquidate their investments within the stipulated 30-day period, they must make a 100% provision on such investments.

The norms apply to direct and indirect investments by AIF schemes in debtor companies within the preceding 12 months. Investments by lenders in the subordinated units of any AIF scheme with a ‘priority distribution model’ are subject to a full deduction from the regulated entity’s capital funds. The term ‘priority distribution model’ is defined in accordance with a Sebi circular.

#Loan #RBI #cracks #alternative #investment #funds #misuse