IT sector slowdown to hit increments! Top IT giants may cut salary hikes by half as slump hurts

[ad_1]

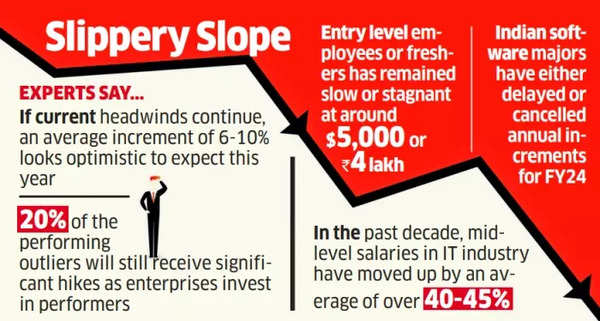

Kamal Karanth, co-founder of Xpheno, a Bengaluru-based staffing firm, emphasized that if the prevailing challenges and the decline in global tech spending persist, even the 6-10% projection may appear optimistic.Nonetheless, he pointed out that approximately 20% of high-performing employees can still anticipate substantial pay raises, as companies focus on retaining their top talent.

For those with weaker performance records, smaller increments are likely. Overall, the outlook for salary increases across the industry is not very promising, Karanth said.

According to TCS‘s annual report released in June, the average salary hike for employees at the largest IT firm, TCS, dropped to single digits, ranging from 6% to 9% in FY23, down from a 10.5% increase in the previous year. Salary raises for managerial positions also saw a significant decrease, falling to 13.6% in the last fiscal year from 27.4% in FY22.

Data from Xpheno reveals that over the last three years, major IT service companies collectively increased compensation costs by 64%, while their combined revenues grew by slightly over 57%. This suggests that the cost of inputs significantly outweighs the output being generated.

IT sector increments

The IT industry is experiencing a period of adjustment in salary trends, marking the end of its prosperous phase at least until the end of the current year. This comes as the industry faces one of its weakest growth quarters.

Viswanath PS, MD, and CEO of global recruitment firm Randstad India, highlighted that previously, IT was seen as a distinct sector driving salary increments independently, with no reference point to other industries. However, the landscape is evolving as the industry grapples with the same challenges of cost management as others.

According to Viswanath, there is a “definite correction” as salary hikes in the IT sector have decreased from approximately 11-12% to 10.8%. He anticipates that the IT sector will likely regain its strength in verticals by April of the next year.

Over the past decade, mid-level salaries in the IT industry have risen by an average of 40%-45% when considering the tech sector as a whole. Meanwhile, the compensation structure for entry-level employees or freshers has shown sluggish growth, remaining at around $5,000 or Rs 4 lakh, according to data from Xpheno.

Human resource (HR) firms report a decline in talent competition as hiring cools down in the market, squeezing margins for most tech companies. While enterprise order books are on the rise, salary increments are expected to be cautious and closely monitored in the near future.

In light of subdued growth in recent quarters, leading Indian software companies have postponed or canceled annual salary increments for the current fiscal year ending in March 2024.

Earlier this month, global IT giant Accenture informed its India and Sri Lanka-based employees via email that they would not be getting salary hikes in 2023.

Indian IT giants, including Tata Consultancy Services (TCS), are implementing delayed wage increases this month. HCLTech, in response to growth limitations among top-tier companies, has excluded middle and senior-level employees from the current increment cycle.

Infosys, the country’s second-largest IT firm, is initiating its annual compensation cycle, with hikes still pending from the previous performance cycle.

Personnel expenses, accounting for 50-60% of total expenses in the IT sector, are under focus in the current times. Reduced business from existing customers, coupled with these high expenses, is driving the IT sector’s focus on cost optimization and reduced hiring.

ET had earlier reported that the top three Indian IT companies—TCS, Infosys, and HCLTech—may see a combined reduction of up to 50,000 employees, underscoring the challenging demand environment for their services.

The IT sector, historically the largest employer in the corporate sector, is turning to internal talent deployment for projects to enhance employee utilization and operating margins in the face of slowing and uncertain demand.

Despite these challenges, Viswanath from Randstad believes that IT industry salaries will not decline in real terms when compared to other industries.

#sector #slowdown #hit #increments #Top #giants #cut #salary #hikes #slump #hurts