Iran-Israel conflict sparks selloff, sensex tanks 845 points

[ad_1]

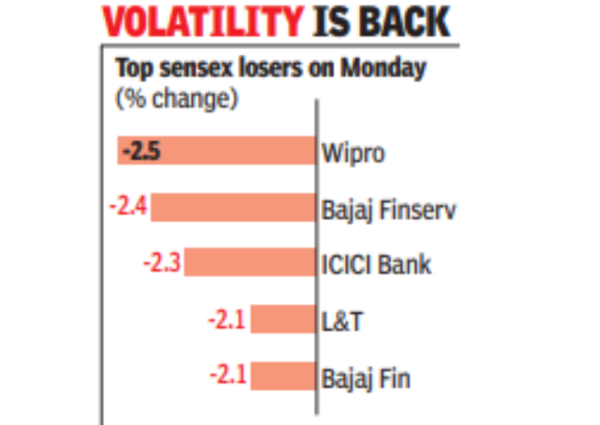

Selling was broad-based with 27 of the 30 sensex stocks closing in the red. Foreign funds sold aggressively while domestic institutions were strong buyers, BSE data showed. On the NSE, Nifty lost 247 points to close at 22,273.

In addition to the geopolitical tensions in West Asia, rising inflation in the US which could potentially delay rate cuts by the Federal Reserve also weighed on investor sentiment, brokers and fund managers said.

According to Naveen Kulkarni, chief investment officer, Axis Securities PMS, geopolitical tensions and inflationary headwinds in the western world have led to pressure on equity markets worldwide. “While India is relatively better placed, higher crude oil prices are a significant dampener. (On the positive side), according to the news flow at this juncture, the escalating geopolitical tensions are not very high, (hence) market corrections may not be very significant,” Kulkarni said.

In Monday’s session, while foreign portfolio investors were net sellers at Rs 3,268 crore, domestic funds were net buyers at Rs 4,763 crore, BSE data showed.

Among sensex constituents, only three stocks — Maruti, Nestle and Sun Pharma — closed with gains. Selling was more pronounced in mid-cap and small-cap segments, as a result of which, BSE’s mid-cap and small-cap indices each closed 1.5% down. In the broader market, there were 3,043 stocks that closed with losses compared to 877 with gains.

In the next few days, in addition to the ongoing conflict in West Asia, quarterly results from large corporates would also dictate the market’s direction, brokers and dealers said.

#IranIsrael #conflict #sparks #selloff #sensex #tanks #points