In Charts: How India can reduce dependence on China for imports by leveraging PLI schemes

[ad_1]

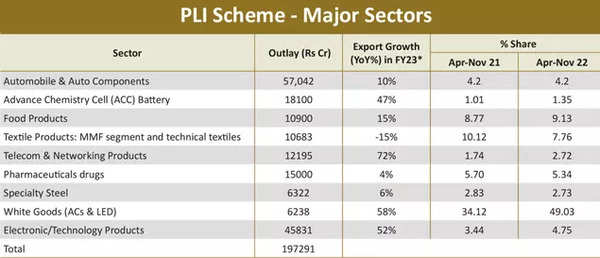

The production-linked incentive scheme, which is a flagship offering of the Narendra Modi government, has been touted as one which would eventually help make India a robust manufacturing machine and a credible alternative to China. The PLI schemes envisage a cumulative $21 billion investment.

In March 2020, India had announced the PLI schemes across 14 sectors including automobiles, auto components and electronics amongst others at an outlay of Rs 1.97 lakh crore, under the ‘Aatmanirbhar’ Bharat mission.

The government is planning to extend the PLI schemes worth Rs 35,000 crore to different sectors such as containers, electrolysers, power transmission equipment, etc.) to ensure manufacturing CAPEX continues to remain elevated beyond FY26.

These 14 sectors currently constitute around 40% of the total imports.

The share of China in India’s total imports have already declined from 15.5% in fiscal 2021 to 13.7% in FY23 (Apr-Nov).

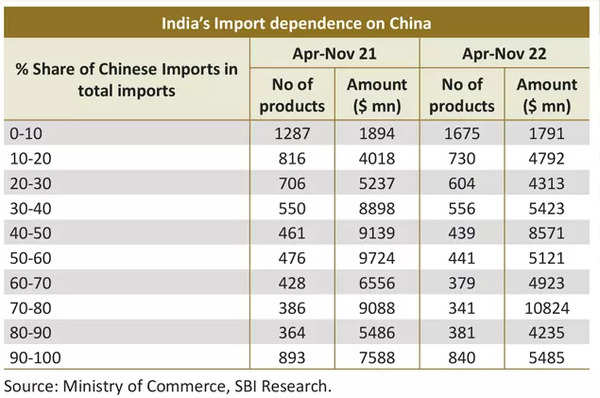

In FY23 Apr-Nov 22, there were 6,386 products with total value of $55 billion (or 13.7% of the total imports) imported by India from China. SBI Research estimated the import dependence of each product on China, by checking the share of Chinese imports in India’s overall imports of these categories.

Source SBI Research

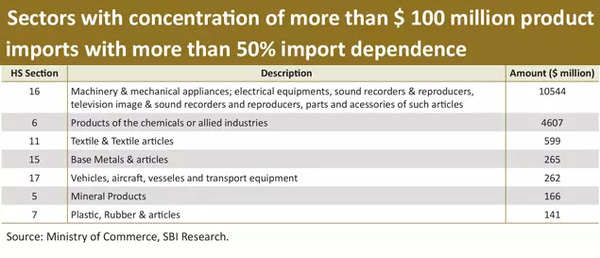

Sectors with concentration of more than $ 100 million product imports with more than 50% import dependence

It found that the maximum aggregate value ($10.8 billion) is of the products in which India’s import dependence on China is between 70-80%, although the number of products is lower.

Although number wise the imports were highest in the category where India’s dependence was lowest (0-10%), the value is not that high at around $1.8 billion.

When it looked at the data where the import value was between $100 million and $500 million, where the import dependence was more than 50%, the sectors in which the imports are concentrated are Chemicals especially Organic, Machinery and Mechanical appliances and Electrical Machinery, Textiles and Textile Articles, Motorcycle Accessories, Oxygen Therapy Apparatus etc.

SBI Research

In FY23 Apr-Nov’22 period, of $55 billion of imports from China, around $38 billion is commodities and goods where PLI scheme has been announced (textile, agri, electronics goods, pharmaceuticals & chemicals). Projecting imports for the full year FY23, total imports of these goods could be $57 billion. “If by leveraging PLI scheme we can reduce our dependence on China even to the extent of 10%, then we can add around $6 billion to our GDP and overtime if our dependence is further reduced by 30%, we can add $17 billion to GDP because of the incentives to domestically manufacture these goods owing to the PLI scheme,” said SBI Research in a note.

Even Kotak Mahindra Bank in its 2023 outlook report noted that India is likely to get a structural push to manufacturing coming from China plus one strategy (a strategy in which companies diversify their businesses to alternative destinations other than China) and PLI schemes.

“The emergence of Europe plus one theme due to the looming energy crisis in Europe would bode well for India as it becomes an attractive investment destination given its lower cost advantage and macro stability of the country,” the report said.

The bulk of the production-linked incentive (PLI) capex that companies have to put in will be concentrated between FY24 and FY26 as most of the major sectors start manufacturing activities from FY24 onwards, according to a report by ratings firm ICRA.

The rating agency said that over the past couple of years, the PLI schemes have had encouraging bids across sectors, but the deployment of capex is expected to pick up only in FY24 for more than 80% of the invested projects such as semiconductors.

Rohit Ahuja, head of research and outreach at ICRA, said, “Based on our calculations, the annual CAPEX from the PLI schemes are expected to cross ₹1 trillion from FY24 and may peak out at ₹1.7 trillion in FY26. Hence, FY24 could be an inflexion point for a surge in India’s manufacturing CAPEX.”

A recent report from implementing ministries/ departments shows around Rs 47,500 crore ($6 billion) of actual investment has been made; production/ sales of Rs 3.85 lakh crore (US$ 47 billion) of eligible products and employment generation of around 3 lakh has been reported and 106% achievement of actual investment reported versus the corresponding projections of FY22.

Some of the latest developments under the PLI programme include the launch of a design-led PLI in June 2022 to promote the entire value chain in telecom manufacturing and to build a strong ecosystem for 5G as part of the PLI Scheme for Telecom & Networking products. As per the Economic Survey, approvals under this Scheme have already been granted to eligible companies.

In September 2022, the Cabinet approved PLI Scheme (Tranche II) on ‘National Programme on HighEfficiency Solar PV Modules’, with an outlay of Rs 19,500 crore to build an ecosystem for manufacturing of high-efficiency solar PV modules in India, thus reducing import dependence in the area of renewable energy.

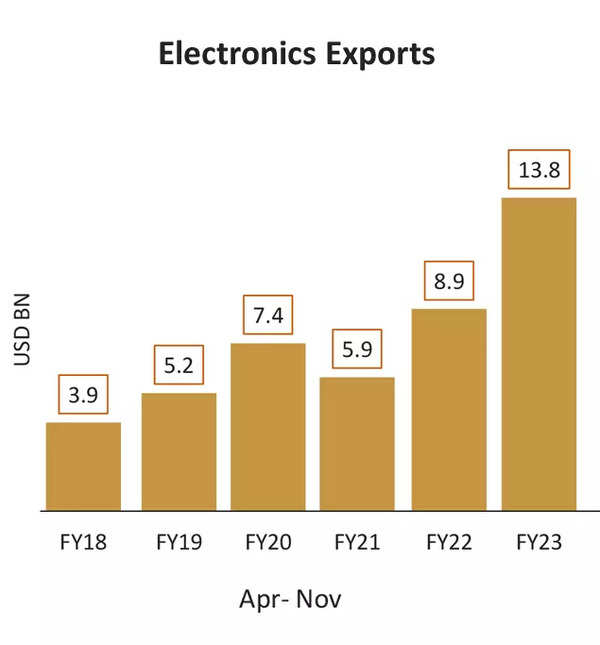

SBI believes PLI has already started yielding the intended results. “For example, export in Electronics space reported a 2.3x jump in FY23 (April to Nov) as compared to the same period in FY21. Further, investment announcements in Electronics sector increased to Rs 2.63 lakh crore in FY23 (April to Dec) from Rs 0.75 lakh crore in FY22 reflects traction in the space post PLI.

Source: SBI Research

“The amount announced by the Government is not even 1% of the GDP and that too spread over 5 years. The number of jobs and incremental production that it is expected to bring is huge. Some have suggested that the scheme amounts to unnecessary subsidy burden on the Government and the cost of this scheme is much more than the benefits. However, if we look at the petroleum subsidy it has declined over the years. During FY12 to FY15, the total petroleum subsidy amounted to Rs 3.11 lakh crore, it has reduced to Rs 2.01 lakh crore during FY16-FY24, a reduction of Rs 1.09 lakh crore,” said Doctor Soumya Kanti Ghosh, Group chief economic adviser at SBI.

Watch Budget 2023: PLI scheme benefitting exports & localisation

#Charts #India #reduce #dependence #China #imports #leveraging #PLI #schemes