High rating upgrades signal strong H1 show by India Inc

[ad_1]

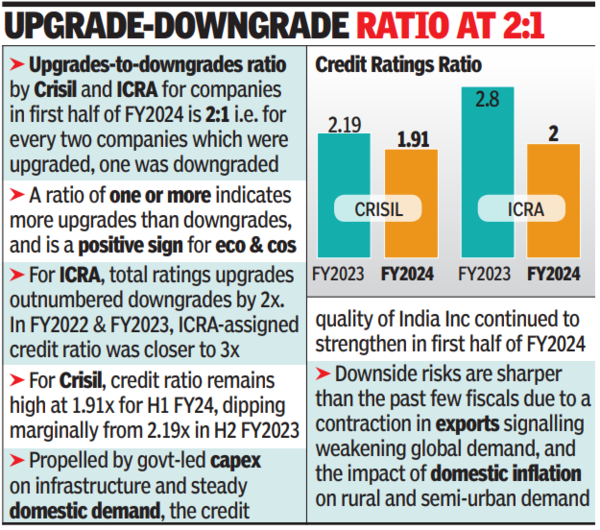

During these six months, the ratings upgrades-to-downgrades ratio by both credit ratings companies was nearly 2:1, i.e., for every two companies which were upgraded, one was downgraded. A ratio of one or more indicates more upgrades than downgrades, and is a positive sign for the economy and the corporate sector.

In its report, Crisil said that although domestic oriented companies were seeing high capacity utilisation, high interest rates and an uncertain inflation outlook were preventing them from embarking on capacity expansion.

For Crisil, credit ratio moderated in H1FY24 to 1.91 from 2.19 in the second half of the last fiscal, a company release said. “There were 443 upgrades and 232 downgrades.”

For ICRA, in H1 FY24, total instances of rating upgrades outnumbered that of downgrades by a factor of two. In comparison, in both FY22 and FY23, the credit ratio of the ICRA-assigned ratings was closer to 3x, it said in a release.

ICRA’s portfolio saw a lone instance of default in H1 FY24, compared with 22 defaults seen in FY23. “The said default pertained to an entity that had a peak rating of BB- during the 12 months prior to default.”

Overall, according to analysts at ICRA, in H1 FY24, the credit quality of India Inc continued to strengthen, “building upon the strong performance observed in the preceding two fiscal years, led by domestic consumption and investment-focused sectors. Both the investment grade as well as the non-investment grade categories showed a net improvement in their credit profiles, even as the pace of improvement moderated in comparison with the previous two fiscals.”

According to Crisil, in the months ahead, six sectors will face headwinds in terms of operating cash flows or balance sheet strength. “The export-oriented and commodity-linked sectors in this bucket are likely to see an impact on operating cash flows, while their balance sheets remain healthy. Export-oriented sectors such as textiles, cotton spinning and diamond polishing could see operating cash flows shrink,” the report noted. As for capex, government spending has been rising while the private sector has not driven a meaningful pick-up, Crisil said.

On the positive side, “(for) domestic and infrastructure-linked sectors, the conditions now seem ripe for the much-awaited private capex cycle to restart, given the increase in capacity utilisation, deleveraged balance sheets and steadfast demand. However, with only brownfield expansions seen in some pockets, a significant uptick in private-sector capex may be a few quarters away as India Inc remains circumspect about higher interest rates and inflation leashing demand,” said Gurpreet Chhatwal, MD, Crisil Ratings.

#High #rating #upgrades #signal #strong #show #India