Hdfc: Personal loans log record 32% growth after HDFC merger

[ad_1]

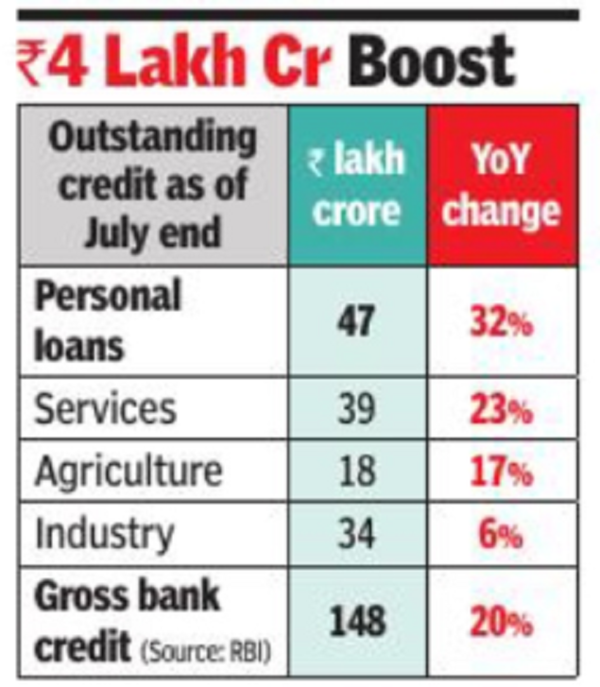

The merger, which added over Rs 4.3 lakh crore in home loans to the bank’s portfolio, pushed overall bank credit growth to 19.7%. RBI data indicates that the merger contributed five percentage points to the growth in bank credit. Without the merger, the year-on-year increase would have been 14.7%. Bank credit stood at Rs 148 lakh crore as of July 28.

Within personal loans, the housing finance portfolio of banks surged by 37.4% to reach Rs 24.3 lakh crore as of July-end. It would have been Rs 20 lakh crore without the merger.

Another consequence of the merger was a slowdown in bank credit extended to housing finance companies. Additionally, there was a 12.3% year-on-year increase in bank credit to the commercial real estate sector, reaching Rs 4 lakh crore, which would have been Rs 3.3 lakh crore without the merger.

Given that credit growth to the industry sector remains in single digits, the primary driver for loan growth is advances to the services sector, with non-bank finance companies (NBFCs) being the major consumers of bank credit. “Lending to NBFCs grew by 23.6% year-on-year in July 2023, compared to 24.6% in July 2022. As anticipated, the outstanding amount to NBFCs declined month-on-month due to the reclassification of HDFC’s borrowings,” said CareEdge Ratings.

#Hdfc #Personal #loans #log #record #growth #HDFC #merger