HDFC merger marks rise of private banks

[ad_1]

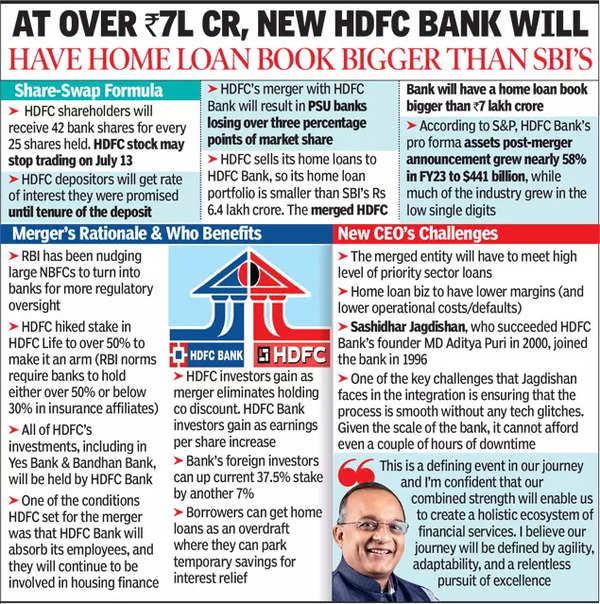

This merger signifies a significant transformation for HDFC Bank, making it the second-most valuable Indian company, surpassing TCS and trailing only RIL (see graphic). Moreover, it marks the end of an institution that pioneered large-scale, profitable and socially relevant housing finance in the private sector.

Factoring the merger, HDFC Bank’s assets will be 58% higher than the previous year. Given that other private banks are growing much faster than peers in the public sector, the gap between the two will further narrow.

The final market capitalisation of the two entities will be determined around July 17, considering the value of the merged company, factoring in the impact of cancelled HDFC shares and the elimination of the holding company discount on earnings per share.

As part of the amalgamation process, HDFC Investments (HIL) and HDFC Holdings (HHL) will first merge with their parent company HDFC, which will then merge with HDFC Bank, effective July 1. HDFC Bank will issue 42 equity shares (with a face value of Re 1 each) for every 25 equity shares (with a face value of Rs 2 each) held by HDFC shareholders as of the record date, which is July 13. The shares owned by HDFC, HIL and HHL in HDFC Bank will be cancelled according to the plan, and no dividend will be paid on them.

HDFC chairman Deepak Parekh, who is retiring as a result of the merger, expressed confidence in the preservation of the “HDFC way of working”. He expressed his hope that the core values of kindness, fairness, efficiency, and effectiveness would continue to be upheld within the HDFC group.

In his final letter to shareholders, Parekh emphasised optimism regarding the economy and the potential of housing finance. He acknowledged the uncertainty of the future and the risk organisations face by sticking to the status quo. He stressed the importance of courage in embracing change, as it brings adaptability, growth, and new aspirations. Parekh assured shareholders that the merger aims to ensure a future without limitations for all stakeholders.

Parekh also reassured shareholders that the work culture of the merged entity would incorporate the best practices from both organisations while maintaining the underlying ethics and value systems of HDFC. He highlighted the confidence he derived from the agreed principle of integration to preserve the “HDFC way of working”, a sentiment shared by the leadership at HDFC Bank.

#HDFC #merger #marks #rise #private #banks