Govt removes long-term tax benefit for debt mutual fund investors

[ad_1]

These benefits accrued to investors who held investments in debt, gold schemes and some categories of hybrid schemes for more than three years.

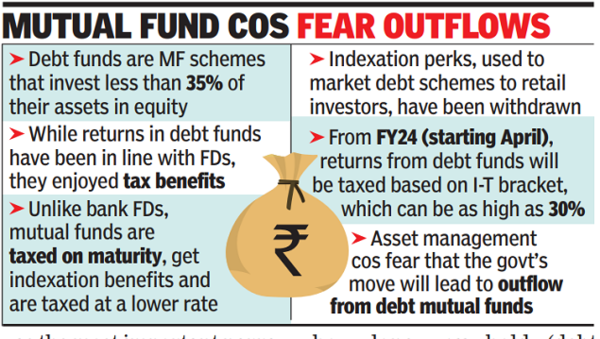

The government defines debt funds are those schemes that hold less than 35% equity in their portfolio.

Fund industry veterans believe that the move will hurt retailisation of mutual funds. “In debt mutual funds, indexation was the most important narrative for the industry’s efforts to retailise debt,” said D P Singh, deputy managing director & CBO, SBI MF.

“With the proposed amendments, surely the overall ecosystem will get impacted, especially the NBFC space. However, taxation is not the only part to be considered while looking at debt funds, there are still many other benefits over traditional investment options,” Singh said.

In a column, Dhirendra Kumar of Value Research termed the government’s move as ‘the unfair tax’. “No matter how long you hold (debt funds), when you sell (these funds), the gains will just be added to your income in that year. Thus, it will be taxed at whatever income tax slab you are in,” he said.

Kumar said that indexation is essentially inflation-adjustment. “It is not a tax exemption, nor is it a gift from the government. It is a compensation for inflation, for the fact that the value of money degrades over time and much of the so-called gains over the years are just an illusion.”

Although the move to take away indexation benefits for debt funds could make these schemes less popular among investors, this change could have a ‘moderate to low’ impact on the revenues and profits of asset management companies (AMCs), foreign brokerage CLSA said.

“We believe this is moderate-to-low impact as bulk of the revenue/profitability for asset management companies accrues from equity (assets under management, AUMs) and non-liquid debt AUMs are neither higher growth nor higher profitability segments,” CLSA analysts said.

Stocks of AMCs, however, witnessed strong selling in Friday’s weak market.

UTI AMC lost 4.7%, Birla Sun Life AMC lost 4.4%, while HDFC AMC lost 4.2%.

Currently, about 19% of the fund industry’s total AUM of nearly Rs 40 lakh crore is invested in non-liquid debt schemes, the ones which are to be impacted by the government move.

CLSA believes one of the segments of the market that could be affected by this change are the non-banking finance companies and housing finance companies (NBFCs) that meet a bulk of their funding needs from the MF industry.

“With potentially lower inflows in debt mutual funds, NBFCs/HFCs may have to rely more on bank funding versus funding from mutual funds,” it said.

#Govt #removes #longterm #tax #benefit #debt #mutual #fund #investors