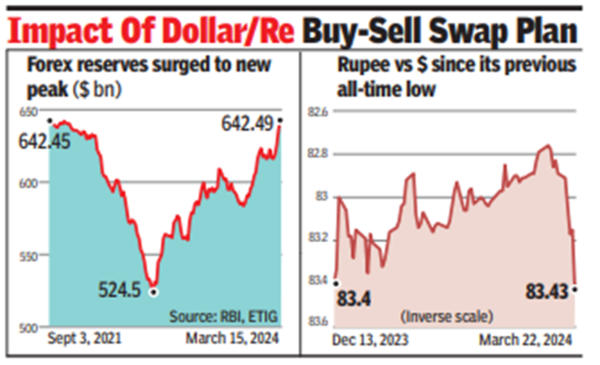

Forex kitty hits record $642.5 billion, Rupee at new low

[ad_1]

Bankers said there was no irony in the reserves gaining strength and the rupee weakening simultaneously.This is because RBI had taken a conscious decision to absorb $5 billion this week as part of its foreign exchange management given that additional dollar flows are expected in the next financial year.

This week, RBI absorbed $5 billion from a dollar/rupee sell-buy swap that matured on Monday. This sell-buy swap undertaken in March 2022 was a strategic move aimed to alleviate pressure on the rupee, which had been impacted by global events such as Russia’s invasion of Ukraine, leading to increased crude oil prices. By accepting dollars through the sell-buy swap, RBI injected about Rs 40,000 crore of liquidity into the money market. This infusion of liquidity facilitated record bond auctions conducted by RBI on behalf of state govts without significantly affecting yields.

The March 15 milestone surpasses the earlier high of $642.45 billion achieved in Sept 2021. Numbers for forex reserves are reported every Friday. The latest data reveals an increase of $6.4 billion compared to the previous week. The forex reserves consist of three main components, with foreign currency assets comprising the majority at $568.4 billion. Gold holdings contribute $51.1 billion, while special drawing rights with the IMF stand at $18.3 billion. The dollar’s strength, driven by favourable risk sentiment and economic optimism in the US, has exerted pressure on the rupee.

“The rupee’s fall is mainly due to dollar index going up as the Fed indicated about future rate cuts. Forex reserves are up due to fundamentals being good on balance of payments, leading to accretions. Also, we must recognise that forex data is lagged by a week and revaluation effect will be seen in due course of time,” said Madan Sabnavis, chief economist, BoB.

On Friday, RBI’s board met in Nagpur to review global and domestic economic conditions. During the meeting, the board approved RBI’s budget for FY25.

#Forex #kitty #hits #record #billion #Rupee