Financial frauds on the rise! How government plans to check SIM cloning, QR code & digital payments fraud

[ad_1]

One of the proposed measures is the implementation of mandatory filters for transactions above a certain monetary threshold, according to an ET report. This includes the use of one-time passwords (OTP) for digital payments. The aim is to enhance security and prevent fraudulent transactions. Additionally, the government is exploring the creation of intelligence within payment systems to identify and block suspicious activities.

To combat cloning of mobile phone SIMs and the fraudulent usage of QR codes, multiple authentication modules and filters are being considered. These additional security measures will help protect users from potential financial fraud.

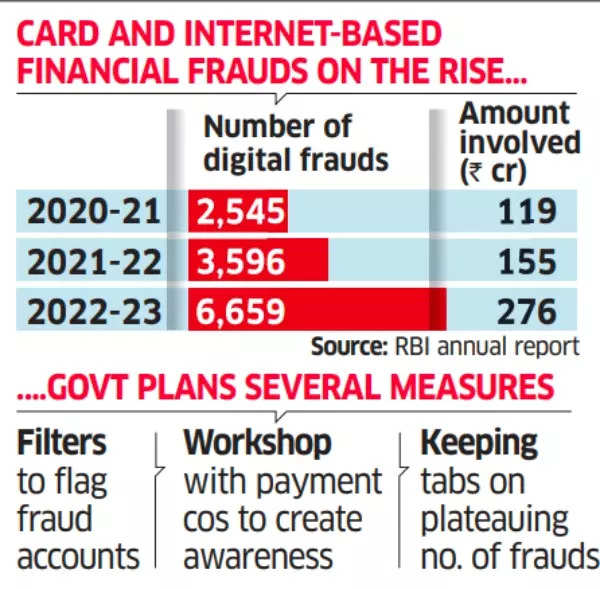

Card and Internet based financial frauds on the rise

With the increasing adoption of digital payments, the risks associated with financial fraud have also risen. According to government data till November 15, 2023, over 1.3 million complaints have been registered since the introduction of the national cyber reporting system in August 2019.

UPI Transactions & RuPay Cards: What’s The Next Milestone for India’s Digital Payments Revolution?

In response to these challenges, various agencies are closely monitoring recent bank fraud cases. Their objective is to warn the public and implement effective preventive measures. The government’s focus is to ensure that systems are alert and intelligent enough to detect and prevent fraudulent transactions in a timely manner.

The urgency to address these issues became apparent after UCO Bank reported an erroneous credit of Rs 820 crore to its account holders through the Immediate Payment Service (IMPS). Authorities have already taken action against digital fraud by suspending approximately 7 million mobile numbers associated with suspicious transactions.

To assess the current situation and the effectiveness of measures taken thus far, the Department of Financial Services (DFS) recently conducted a meeting with key stakeholders. Banks have been urged to strengthen their systems and processes and raise awareness among customers. The DFS plans to review progress in January through another meeting.

#Financial #frauds #rise #government #plans #check #SIM #cloning #code #digital #payments #fraud