Current a/c deficit shrinks in March quarter as imports dip

[ad_1]

During the March quarter, remittances were pegged at $28. 6 billion, nearly 21% higher than the fourth quarter of 2021-22.

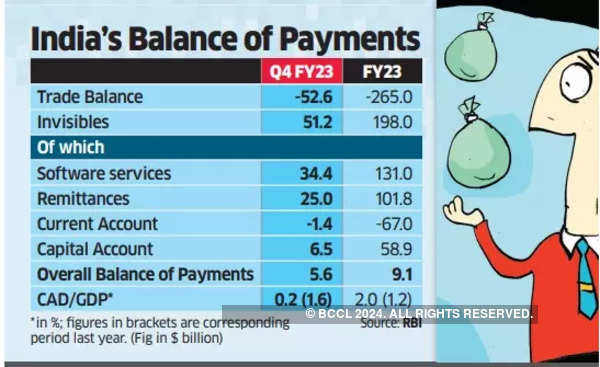

Data released by the central bank estimated that the current account deficit narrowed to $1. 3 billion, or 0. 2% of GDP, during the March quarter, compared to $13. 4 billion a year ago, which was estimated at 1. 6% of GDP as the trade deficit narrowed on account of a slowdown in imports and services exports soared.

For the full year, the CAD widened to 2% of GDP or $68billion as against $38. 7 billion during 2021-22, which was 1. 2% of GDP. This was largely on account of a higher trade deficit, which is estimated to have widened to $265 billion, compared with $189. 5 billion in FY22.

Current account balance measures the gap between exports and imports, domestic and overseas investments and remittances to and from the country.

In terms of India’s balance of payments (BoP), the country recorded a surplus of $5. 6 billion, compared to a surplus of $11. 1 billion in the previous quarter and a deficit of $16 billion in the sameperiod a year earlier.

“We expect further improvement on the back of lower commodity prices. Merchandise exports are expected to remain downbeat as global growth weakens. Overall, we expect CAD in the range of 1. 21. 6% of GDP in FY24,” said Aditi Gupta, an economist with the Bank of Baroda.

DK Joshi, economist with Crisil, said, “CAD is expected to rise on-quarter in Q1FY24 as the merchandise trade deficit has widened again and the services trade surplus has moderated a tad.”

Inward remittances by Indians working overseas crossed $100 billion for thefirst time with private transfers, which largely represents the money sent by techies in the US and workers in the Persian Gulf to their family members here, pegged at over $112 billion during 2022-23, data released by the RBI on Tuesday showed.

Economists and the central bank are also upbeat on the flows during the current financial year, arguing that the slowdown in the US and Europe is unlikely to impact remittances.

“The remittances have remained robust and we expect to have strong inflows this year as well,” said an official. A World Bank report had said that remittances have benefited from a gradual structural shift in Indian migrants’ key destinations from largely lowskilled, informal employment in the Gulf Cooperation Council (GCC) countries to a dominant share of high skilled jobs in high-income countries such as the US, the UK, and East Asia ( Singapore, Japan, Australia and New Zealand).

#Current #deficit #shrinks #March #quarter #imports #dip