Business

Common Issues and Solutions for Stuck or Failed UPI Transactions | Business

[ad_1]

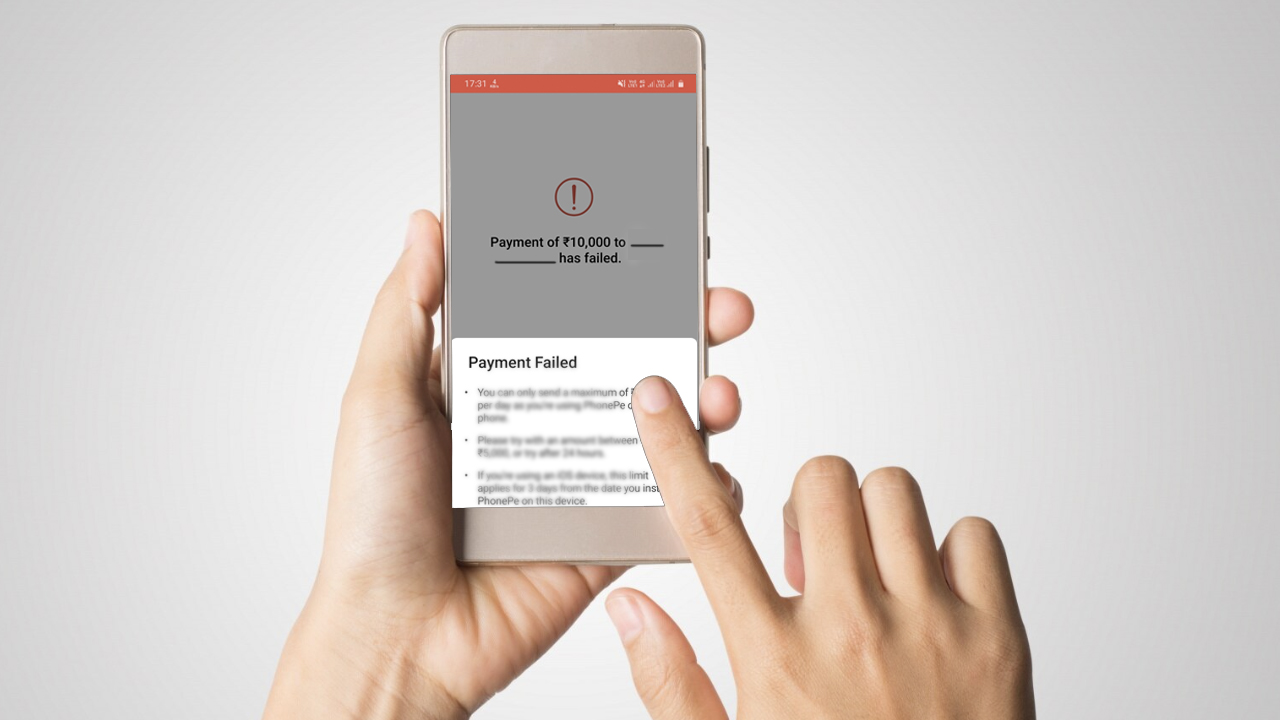

UPI failed transactions: The introduction of the Unified Payments Interface (UPI) has made our daily transactions much easier. Whether we’re shopping at a mall or fueling our vehicles at a petrol pump, we can now make payments online with just a few taps on our smartphones. However, as more people rely on UPI and carry less cash, in case UPI experiences issues or doesn’t work properly, it can be inconvenient.

Imagine trying to pay a merchant at a shop, but the UPI transaction fails or gets stuck.In such situations, you might anxiously wait for the transaction to complete or ask a friend for cash help.

But what makes UPI payments fail? There are various reasons for payment failures during UPI transactions. Incorrectly entering the UPI ID, providing an inaccurate receiver’s address, encountering server problems with the bank, or experiencing connectivity issues with the internet can all lead to transaction failures.

ALSO READ | When does a bank account go dormant? You can reactivate it at no cost – here’s how

Here are some UPI payment issues and how you can deal with them as per the National Payments Corporation of India (NPCI):

Entered wrong UPI PIN

If you input the wrong UPI PIN, your transaction will fail. Some banks may temporarily block UPI transactions if the wrong PIN is entered multiple times.

Forgot UPI PIN

If you forget your UPI PIN, you can easily generate a new one using your debit card details. Simply provide the last six digits of your debit card and its expiry date to initiate the process of re-generating your UPI PIN.

Payment made, but not received by other party

After completing a transaction, you should see a success message on the screen and receive an SMS confirmation from your bank. If you haven’t received confirmation within an hour, contact your bank’s customer support.

Failed transaction, account debited

In the event of a failed transaction, the money will be refunded to your account. However, refunds may sometimes take longer than expected. If you haven’t received the refund within an hour, contact your bank’s customer support.

Transaction showing ‘Pending,’ amount debited but not credited

If your transaction status is “Pending” and the amount has been debited but not credited to the beneficiary, there might be a delay due to issues at the beneficiary bank’s end. Typically, the amount will be credited within 48 hours once the bank completes its daily settlements.

Imagine trying to pay a merchant at a shop, but the UPI transaction fails or gets stuck.In such situations, you might anxiously wait for the transaction to complete or ask a friend for cash help.

But what makes UPI payments fail? There are various reasons for payment failures during UPI transactions. Incorrectly entering the UPI ID, providing an inaccurate receiver’s address, encountering server problems with the bank, or experiencing connectivity issues with the internet can all lead to transaction failures.

ALSO READ | When does a bank account go dormant? You can reactivate it at no cost – here’s how

Here are some UPI payment issues and how you can deal with them as per the National Payments Corporation of India (NPCI):

Entered wrong UPI PIN

If you input the wrong UPI PIN, your transaction will fail. Some banks may temporarily block UPI transactions if the wrong PIN is entered multiple times.

Forgot UPI PIN

If you forget your UPI PIN, you can easily generate a new one using your debit card details. Simply provide the last six digits of your debit card and its expiry date to initiate the process of re-generating your UPI PIN.

Payment made, but not received by other party

After completing a transaction, you should see a success message on the screen and receive an SMS confirmation from your bank. If you haven’t received confirmation within an hour, contact your bank’s customer support.

Failed transaction, account debited

In the event of a failed transaction, the money will be refunded to your account. However, refunds may sometimes take longer than expected. If you haven’t received the refund within an hour, contact your bank’s customer support.

Transaction showing ‘Pending,’ amount debited but not credited

If your transaction status is “Pending” and the amount has been debited but not credited to the beneficiary, there might be a delay due to issues at the beneficiary bank’s end. Typically, the amount will be credited within 48 hours once the bank completes its daily settlements.

#Common #Issues #Solutions #Stuck #Failed #UPI #Transactions #Business