Bombay HC stays bank action under RBI’s circular on fraud accounts

[ad_1]

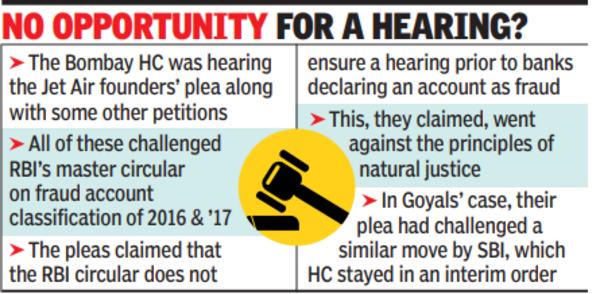

The petitions essentially challenged the RBI’s ‘Master directions on fraud — Classification and reporting by commercial banks and select FIs’ (financial institutions) of July 2016 and 2017. The petitions were filed on the grounds that the circular provides no opportunity of a hearing before banks declare accounts as ‘fraud’, and thus flouts fundamental principles of natural justice.

The HC bench of Justices Gautam Patel and Neela Gokhale was hearing petitions filed by Naresh Goyal, founder of Jet Airways, and his wife Anita Goyal, apart from others. The Goyals challenged SBI’s decision to declare bank accounts as ‘fraud’. The HC stayed the SBI action.

On March 27, the Supreme Court had upheld a judgment of the Telangana high court that mandated a hearing under the RBI master circular.

On Monday, justices Patel and Gokhale first enquired about the clarification order of May 12 passed by the SC in an application filed by SBI. Senior counsel Milind Sathe, appearing for Naresh Goyal, and Gaurav Joshi for petitioner Shreyas Doshi, submitted that the SC had recorded solicitor general Tushar Mehta’s apprehension of it meaning a ‘personal hearing’ and reiterated that its directions are as enunciated in the March 27 order, which said “application of audi alteram partem (hear the other side) cannot be impliedly excluded from the RBI master direction on frauds.

The SC had directed, “The principles of natural justice demand that borrowers must be served a notice, given an opportunity to explain the conclusions of the forensic audit report, and be allowed to represent by banks before their account is classified as fraud under the master direction on frauds.”

Anita Goyal’s petition, argued by senior counsel Aabad Ponda, challenged the action of SBI to classify her bank account as ‘fraud’ pursuant to the RBI master circular. She said she was the former non-executive director and promoter of Jet Airways (India) and never acted as a guarantor to any loans taken by Jet Airways.

The SBI had declared the bank account of Jet Airways as fraud and, consequently, also hers with no prior hearing, said Anita in her petition filed through law firm Naik, Naik and Co.

The RBI counsel submitted that the SC has held that “no opportunity of being heard is required before an FIR is lodged and registered”. On this, the HC clarified that no action can be taken pursuant to any findings under the RBI master circular. But the HC further clarified that banks are entitled, under law, to take any proceedings which are not pursuant to the RBI master circular and does not rely on findings of the fraud declaration

Kuldeep Patil and Shreeram Shirsat, counsels for CBI, submitted that the investigating agencies must be allowed to carry out their investigations.

#Bombay #stays #bank #action #RBIs #circular #fraud #accounts