Benefits In Kind: Should you opt for HRA or rent-free accommodation by employer? Recent tax changes to take note of

[ad_1]

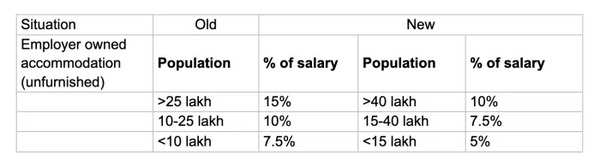

Pursuant to the Finance Act, 2023, the CBDT streamlined the valuation mechanism for RFA provided by the employer (other than Central Government or State Government employers). The new valuation percentages linked to the revised population threshold of cities for an accommodation owned by the employer are tabulated below:

RFA changes

For accommodation taken on lease/rent by the employer, the taxable value of RFA is to be determined as 10% of salary (reduced from 15% earlier) or actual rent whichever is lower, as reduced by the amount recovered from the employee. Further, RFA valuation will be capped based on the cost inflation index (‘CII’) in cases where the employee stays in employer provided accommodation for more than a year. A great move indeed to curb the impact of inflation! It brings smiles for the employers as well as employees who face an automatic increase of the perquisite value every year as their taxable income goes up even while staying in the same accommodation.

The HRA is taxable in the hands of employees subject to exemption limits prescribed under section 10(13) of the Income Tax Act, 1961 (“Act”). Such exemption is available to the extent of lower of the following:

- 50% of salary, where the house is situated in metro cities (40% of salary in other cities);

- The excess of actual rent paid by the employee over 10% of salary;

- Actual HRA received by an employee

With the new rules for RFA valuation and possible reduction of the cost to the companies, it is worthwhile to revisit if company leased accommodation is better than a personal leased accommodation. There are various ancillary factors which play a pivotal role in making such a choice. For example, if the employer picks up the brokerage cost and security deposit amount payable for an accommodation, the same would be taxable in case of HRA since these will be the employee’s personal obligations picked by the employer. However, such additional costs would not be taxable in case of RFA.

Home, Car Loan RBI new guidelines: Latest RBI rules for EMIs, loan switch, penalty explained

Another important factor is the tax regime opted by the employees. The new tax regime is devoid of any exemptions and deductions and is the default regime w.e.f. Financial Year 2023-24. In case the employees get HRA, they may opt for the old regime to claim exemption. Further, the withholding tax compliances get triggered u/s 194IB of the Act where the individuals pay rent more than Rs 50,000 per month. However, in the case of RFA, the withholding tax compliances are undertaken by the companies. With this gamut of possibilities, let us see a sample hypothetical comparison under both the options for ease of understanding (only for reference purposes).

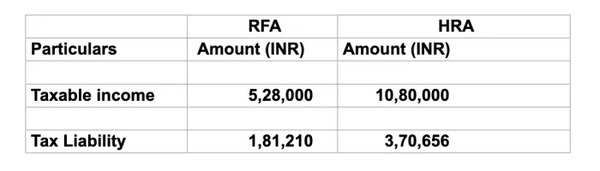

Example: Mr. A draws a salary of Rs 60 lakh (basic salary of Rs 30 lakh, HRA of Rs 15 lakh, other allowances of Rs 10 lakh and bonus of Rs 5 lakh) and the rent of his accommodation is Rs 60,000 per month. In his case, the taxable value and the corresponding tax liability under both the options is as below:

RFA vs HRA

In the above example, RFA is better than HRA, given the taxable value is on a lower side. However, each case would need to be analyzed (factoring salary of the employees, rent payable, personal choice of the employees, administrative burden etc.) to work out which option is better.

(Chander Talreja is Partner, Vialto Partners. Manavi Gupta, Director, Vialto Partners also contributed to the article. Views are personal)

#Benefits #Kind #opt #HRA #rentfree #accommodation #employer #tax #note