Bank credit to NBFCs dips even as credit card debt continues to grow

[ad_1]

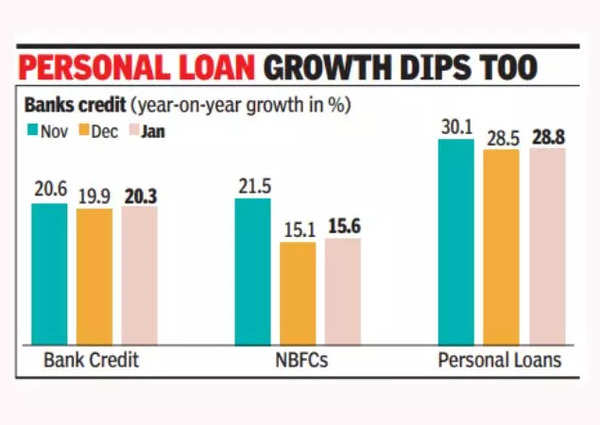

However, credit cards outstanding soared 31% year-on-year – touching a high of Rs 2.6 lakh crore in Jan from Rs 2.5 lakh crore in Dec. While total loans outstanding to NBFCs were Rs 14.9 lakh crore in Nov, in the same month, credit cards outstanding were Rs 2.4 lakh crore. Bank loans to NBFCs grew 21.5% year-on-year in Nov, but slowed to 15.1% in Dec. Credit to NBFCs continued to grow at 15.6% year-on-year in Jan.

As of Jan end 2024, consumer durables grew 14.4% while housing loans surged 37% year-on-year, thanks to the HDFC-HDFC Bank merger. The merger also pushed up overall growth in the personal loan category to 28.8% from the year-ago period. The yearly growth in credit cards was the second-highest at 31.3%.

Education loans grew by nearly 23%, vehicle loans by 16.2% and gold loans and other personal loans by 17.4% and 23.3%, respectively. Overall, bank credit grew 20.3% year-on-year as of Jan end. If the impact of the HDFC merger is excluded, bank credit would be 16.1%.

Services and personal loans continue to be major drivers of bank credit year-on-year, growing 23.9% and 28.8% respectively. Excluding the impact of the HDFC merger, the growth in personal loans was only 21%. Bank credit to industry continued to grow in single digits at 8%.

#Bank #credit #NBFCs #dips #credit #card #debt #continues #grow