Adani prepays loans of $1.1 billion to release pledged group companies shares

[ad_1]

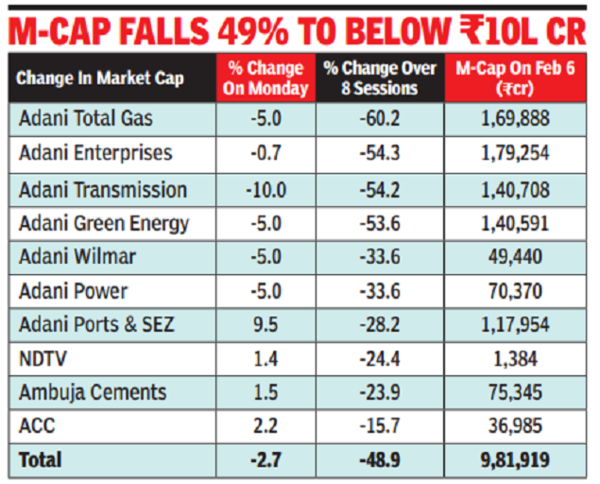

His companies’ stocks have been under selling pressure since January 25 after Hindenburg Research in a report accused the Ahmedabad-based group of stock price manipulation by using shares as collateral.

According to a media statement, Adani’s early repayment will release 12% of his holding in Adani Ports, 3% in Adani Green and 1.4% in Adani Transmission. The statement didn’t mention the extent of loan repaid in each of the three companies. It also didn’t mention how the promoters financed the loan repayment.

Adani prepaid the borrowings much before their maturity time of September 2024 “in light of recent market volatility and in continuation of the promoters’ commitment to reduce overall promoter leverage backed by Adani listed company shares”.

The statement said further: “This is in continuation of promoters’ assurance to prepay all share-backed financing.”

The promoters had pledged 17% of their holding in Adani Ports (they own 65% in the company); 4.4% in Adani Green (they hold 61%) and 6.6% in Adani Transmission (they hold 74%) as of December 31, 2022, group disclosures compiled by ETIG showed.

A few days ago, the group clarified that the promoters haven’t pledged any share of Ambuja Cements and its subsidiary ACC to finance the Rs 51,825-crore purchase of the two cement units. Instead, they have only provided an undertaking to lenders that they will not dispose of their holdings in the two companies. Adani owns 63.2% in Ambuja and 58% in ACC (of which 50% is held through Ambuja).

The early loan repayment in the three listed companies is targeted to scotch the fears of investors about margin calls on these pledges following a massive decline in Adani group stocks in the wake of the Hindenburg accusations. “Equity share pledges are an inherently unstable source of lending collateral because if share prices drop, the lender can make a collateral call,” said US-based Hindenburg in its report.

#Adani #prepays #loans #billion #release #pledged #group #companies #shares