Adani Power: Adani Power up 5% after dropping DB Power deal

[ad_1]

On Wednesday, Adani Power, which is India’s largest private thermal power producer, said the deadline to complete the acquisition of DB Power’s 1,200-megawatt (MW) plant in Chhattisgarh has expired. The development signalled a cutback in spending by Gautam Adani’s conglomerate after the New York-based Hindenburg Research criticised its business practices, which subsequently battered his group’s market value and turned lenders cautious.

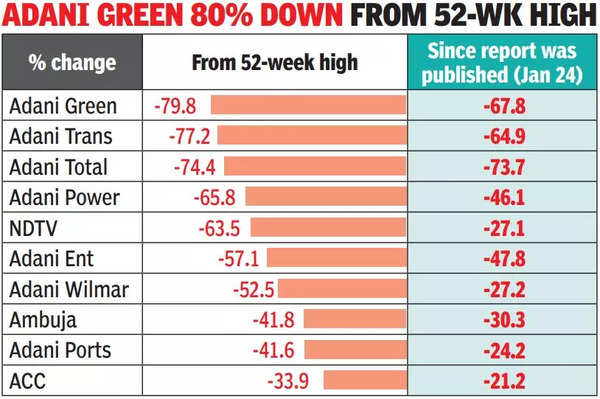

Adani Power’s shares hit a 52-week high of Rs 433 on August 22, 2022 and a 52-week low of Rs 109 on February 24, 2022. The company is also heavily indebted, accounting for 16% (or Rs 36,031 crore) of the group’s combined gross debt of Rs 2. 3 lakh crore. The conglomerate’s combined gross debt excludes the liabilities of the consumer goods and media businesses. Besides Adani Power, five group companies’ stock — Adani Enterprises, Ambuja Cements, Adani Wilmar, NDTV and Adani Ports & SEZ — ended higher on the BSE on Thursday.

Of these, Adani Wilmar and NDTV also closed at the 5% upper circuit limit. On the other hand, four stocks — Adani Total Gas, Adani Green Energy, Adani Transmission and ACC — closed lower.Adani Group chairman Gautam Adani said earlier this week that the current market volatility was “temporary” and that the conglomerate will reduce its debt. He said the group “will continue to work with the twin objectives of moderate leverage and looking at strategic opportunities to expand and grow”.

At close of trade on Thursday, the group’s total market capitalisation showed a marginal Rs 2,554 crore dip, BSE data compiled by TOI showed. Since January 25, the day the crash in Adani Group’s stocks started following the publication of the Hindenburg report, the group’s market cap has fallen in 15 out of the 17 sessions. From a recent high of Rs 19. 2 lakh crore of market value on January 24, it’s now down by Rs 10. 6 lakh crore, or 55%. Among the 10 stocks belonging to conglomerate, Adani Total Gas’s market value is now almost a fourth of what it was on January 24.

#Adani #Power #Adani #Power #dropping #Power #deal