Business

1-year govt bond yield races past 10-yr level

[ad_1]

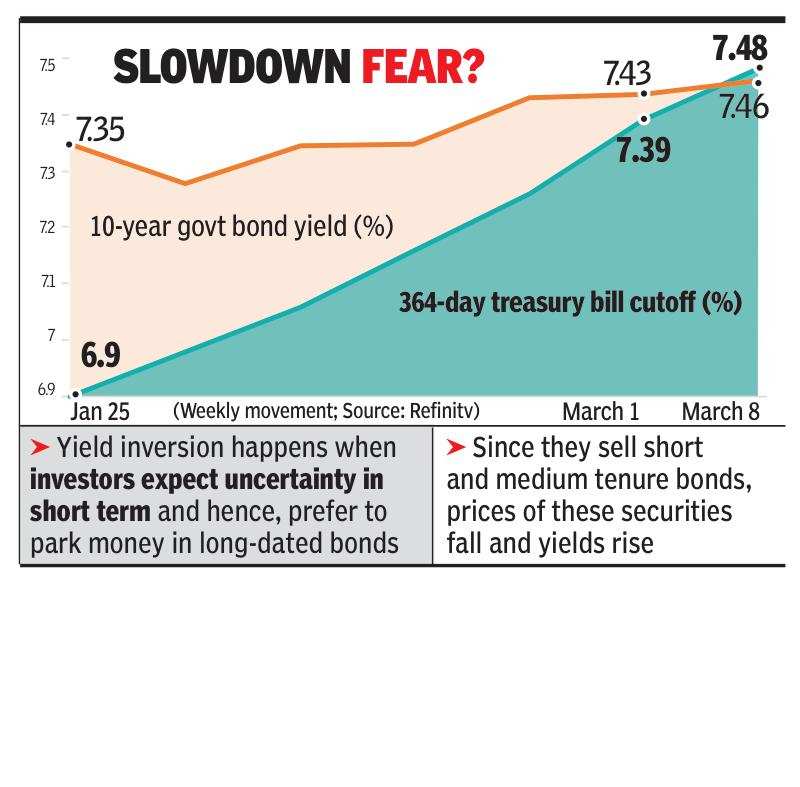

Mumbai: In a phenomenon that indicates slowdown in the economy, yields on 364-day treasury bills (T-bills) rose above the 10-year government bond yield on Wednesday.

A combination of excess supply of short-duration government bonds (T-bills), tight liquidity in the banking system and rate hike uncertainties pushed up near-term yields. In less than two months, short-term yields have jumped more than 60 basis points (100bps = 1 percentage point), while the 10-year yields have increased by 12bps, RBI data showed.

This phenomenon is known as yield inversion and in developed markets it usually points toward a recession. Economists have ruled out such a situation in India, however, a slowdown can be expected.

In Wednesday’s T-bill auction, cut-off yield rose to 7.48% from 7.39% in the previous week and 7.06% a month ago. In comparison, 10-year yield had closed at 7.34% a month ago, while it ended at 7.46% on Wednesday.

On February 24, the government had said that it would borrow Rs 50,000 crore more through T-Bills than what was notified earlier. In addition, the surplus liquidity available in the banking system is about Rs 50,000 crore, down from over Rs 11 lakh crore about 18 months ago.

“Possibilities of further rate hikes, along with tight liquidity and larger than expected supply of T-Bills, have led to the spike in near-term rates,” said Siddhartha Sanyal, chief economist & head research, Bandhan Bank.

Short-term yields are influenced more by system liquidity and central bank actions, bond market players said.

Economists, however, rule out any possibility of a recession in India. “Inversion of the yield curve is typical of an economy which is slowing down. Theoretically, such a phenomenon is seen heralding a recession,” said Madan Sabnavis, chief economist, Bank of Baroda. “While that is not the case here, a slowdown is imminent as seen by the RBI scaling down growth estimates to 6.4% for FY24 from 6.8% in FY22.

A combination of excess supply of short-duration government bonds (T-bills), tight liquidity in the banking system and rate hike uncertainties pushed up near-term yields. In less than two months, short-term yields have jumped more than 60 basis points (100bps = 1 percentage point), while the 10-year yields have increased by 12bps, RBI data showed.

This phenomenon is known as yield inversion and in developed markets it usually points toward a recession. Economists have ruled out such a situation in India, however, a slowdown can be expected.

In Wednesday’s T-bill auction, cut-off yield rose to 7.48% from 7.39% in the previous week and 7.06% a month ago. In comparison, 10-year yield had closed at 7.34% a month ago, while it ended at 7.46% on Wednesday.

On February 24, the government had said that it would borrow Rs 50,000 crore more through T-Bills than what was notified earlier. In addition, the surplus liquidity available in the banking system is about Rs 50,000 crore, down from over Rs 11 lakh crore about 18 months ago.

“Possibilities of further rate hikes, along with tight liquidity and larger than expected supply of T-Bills, have led to the spike in near-term rates,” said Siddhartha Sanyal, chief economist & head research, Bandhan Bank.

Short-term yields are influenced more by system liquidity and central bank actions, bond market players said.

Economists, however, rule out any possibility of a recession in India. “Inversion of the yield curve is typical of an economy which is slowing down. Theoretically, such a phenomenon is seen heralding a recession,” said Madan Sabnavis, chief economist, Bank of Baroda. “While that is not the case here, a slowdown is imminent as seen by the RBI scaling down growth estimates to 6.4% for FY24 from 6.8% in FY22.

#1year #govt #bond #yield #races #10yr #level