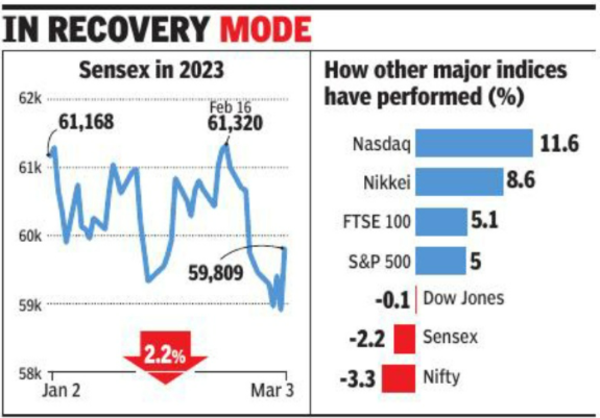

Us Fed: Sensex up 900 points on hopes of slower US Fed rate hikes

[ad_1]

The sensex closed 1.5% higher at 59,809 points, while the Nifty gained 272 points or 1.6% to close at 17,594. Friday’s surge was the second-biggest single-session gain for the sensex in 2023. The rally on Dalal Street was also supported by strong services PMI data that came in at more than a decadal high, and buying by foreign funds, who were mostly sellers in the past week.

According to Siddhartha Khemka of Motilal Oswal Financial Services, investors on Friday cheered the dovish commentary from one of the US Fed officials along with robust domestic services PMI data. “All sectors ended in the green with continued momentum seen in banking, metals and realty (stocks). (The market) is finding some support after declining almost 9% from its peak,” he said. “While domestic macro data continues to remain strong, global uncertainty regarding the next US Fed action have kept the markets volatile.”

The day’s strong gains added about Rs 3.6 lakh crore to investors’ wealth with the BSE’s market cap now at Rs 266.6 lakh crore. In the previous 10 sessions, it had fallen by about Rs 10 lakh crore, official data showed.

Technically, the Nifty is in a safe zone as long as it’s above the 17,400-point level, chartists said. According to Amol Athawale of Kotak Securities, the Nifty has formed a double bottom near the 200-day SMA (simple moving average) and bounced back sharply. “The index has also formed a promising bullish candle on daily and weekly charts which supports further uptrend from the current levels.”

#Fed #Sensex #points #hopes #slower #Fed #rate #hikes