Senior citizens relieved as bank fixed deposit rates touch 8% after 3 years

[ad_1]

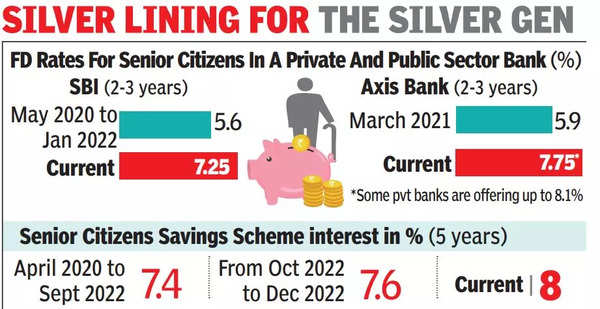

At the peak of the pandemic, rates had dropped to as low as 5.5% due to excess liquidity in the banking system and many had locked into 2-3-year deposits to make the best in a depressed market. Now with some private banks offering 8% and public sector banks giving over 7.5%, savvy elders are looking at premature withdrawals to make fresh deposits at higher rates.

A senior citizen in Mumbai had booked an FD of Rs 2.5 lakh in 2020-end for three years at 5.75% in a private bank with the help of her son. Upon learning that the rate had risen to 7.75% for the same tenure, the son recently broke the FD and rebooked it. His mother will get an incremental income of nearly Rs 20,000.

Last month, the government increased the return on the senior citizen savings scheme (SCSS) with rates regaining the 8% level after falling to 7.4% during the pandemic. However, the gap between SCSS and bank FDs has reduced.

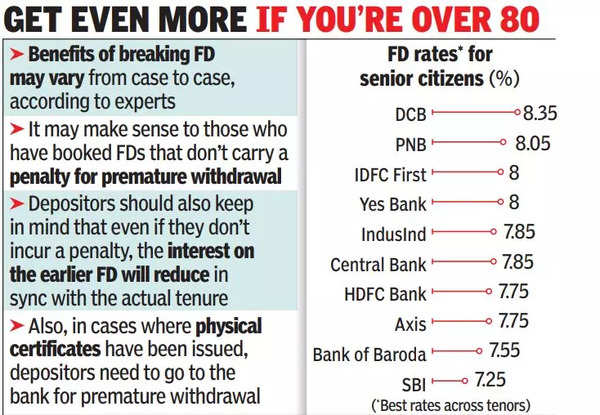

Some banks are offering even higher rates for “super senior citizens”, or those over 80 years. For instance, Union Bank of India offers 75 basis points (100bps=1 percentage point) over its regular rate for super seniors, which means that they can get 8% on 700-day deposits. Punjab National Bank offers super senior citizens 80bps over the regular rate and the highest return for them is 8.1% on 666-day deposits. Indian Bank offers this category of investors 25bps more than other senior citizens.

Another Mumbai-based retiree broke an FD that he had booked less than a year ago to get a rate that was nearly two percentage points higher. While these investors said they did not incur a penalty, experts said the benefits may vary from case to case.

“Breaking an existing fixed deposit may be beneficial to some customers who have invested in FDs that don’t carry a penalty for premature withdrawal,” said Gaurav Gupta, founder & CEO of lending platform MoneyWide.

Even if there is no penalty, the interest on the earlier FD will be reduced in sync with the actual tenure, Gupta added. Another point to note is that FDs can be broken online only if they are booked using netbanking. In cases where physical certificates have been issued, depositors need to go to the bank for a premature withdrawal. Experts said that depositors should approach a financial adviser to determine if they can benefit from a switch.

Meanwhile, the RBI has increased the interest rate on its floating rate savings bonds to 7.35% from 7.15%. This has followed the increase in the National Savings Certificate to 7%.

Some advisers also suggest liquid mutual funds as an alternative to deposits considering the indexation benefit that is available for investments over three years. However, these are not as safe as fixed deposits and their valuation can fluctuate along with the market value of the underlying bonds.

Besides banks, non-banking finance companies are offering attractive returns. HDFC’s “Sapphire” deposit scheme offers up to 7.6% interest rate. The mortgage giant gives higher returns if the deposits are made online and if investors are shareholders. For senior citizens who are shareholders and use netbanking, the return is just short of 8%. Bajaj Finance offers senior citizens up to 7.95% on three-year deposits.

#Senior #citizens #relieved #bank #fixed #deposit #rates #touch #years