Business

LIC seeks clarification from Adani on report

[ad_1]

MUMBAI: A senior LIC official has said that the corporation will seek clarification on the Hindenburg report from Adani Group. The insurance giant has said that it has, over the years, purchased Adani stocks worth Rs 30,127 crore and that they were valued at Rs 56,142 crore as of January 27.

In a statement issued on Monday, LIC said that its total holding under equity and debt in Adani Group is Rs 35,917 crore. “The credit rating of all Adani debt securities held by LIC are AA and above which is in compliance with Irdai investment regulations as applicable to all life insurance companies,” the corporation said. LIC, which has total assets under management (AUM) of Rs 41.6 lakh crore as of September 2022, issued the statement in response to media speculation over the corporation’s exposure to Adani Group. In terms of book value, investments in Adani Group are less than 1% of its AUM, LIC said.

Adani Group stocks have taken a beating in the last three sessions in the wake of a report by Hindenburg Research alleging irregularities. LIC MD Raj Kumar told Reuters that the insurer took a long-term view on its investment “unless there is something going very bad”. He added, “We have to gather all information, clarifications, and a further call will be taken after that. The decision will also be based on an independent risk-assessment, internal risk-assessment, business profile and growth trajectory,” said Kumar.

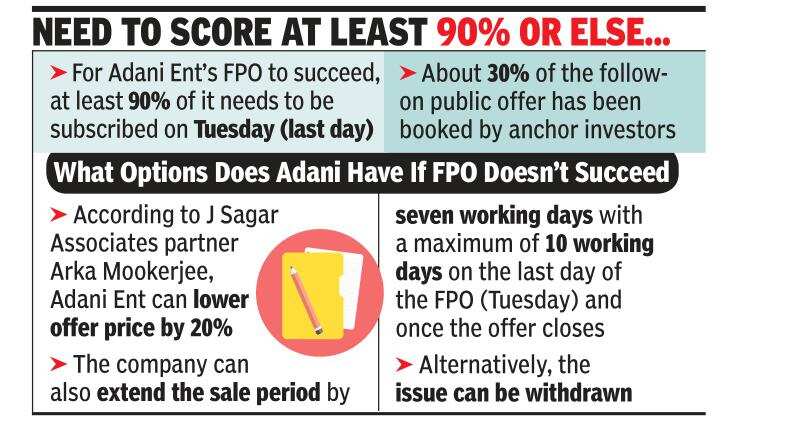

LIC invested Rs 300 crore or 5% of the anchor portion in Adani Enterprises’ follow-on public offer (FPO). LIC holds a 4.2% stake in Adani Enterprises, 9.1% stake in Adani Ports and nearly 6% in Adani Total Gas. Sources said that Adani Group was not LIC’s top investment and the top two were other business houses. A Reuters report said that the corporation is unlikely to make any further investments in the FPO.

Meanwhile, the government announced the appointment of M Jagannath as LIC’s new MD. Jagannath, who was earlier a zonal manager, will take over from Raj Kumar whose term ends on January 31.

Punjab National Bank’s CEO Atul Kumar Goel, while announcing Q3FY23 results, said that the lender has an exposure of Rs 7,000 crore to Adani Group, of which Rs 2,500 is to the airport business. “The exposure is backed by cash flow and the investment is across 8-9 companies. We are keeping a watch on developments in the news, and as of date, there is no worry as there are cash flows,” he said.

In a statement issued on Monday, LIC said that its total holding under equity and debt in Adani Group is Rs 35,917 crore. “The credit rating of all Adani debt securities held by LIC are AA and above which is in compliance with Irdai investment regulations as applicable to all life insurance companies,” the corporation said. LIC, which has total assets under management (AUM) of Rs 41.6 lakh crore as of September 2022, issued the statement in response to media speculation over the corporation’s exposure to Adani Group. In terms of book value, investments in Adani Group are less than 1% of its AUM, LIC said.

Adani Group stocks have taken a beating in the last three sessions in the wake of a report by Hindenburg Research alleging irregularities. LIC MD Raj Kumar told Reuters that the insurer took a long-term view on its investment “unless there is something going very bad”. He added, “We have to gather all information, clarifications, and a further call will be taken after that. The decision will also be based on an independent risk-assessment, internal risk-assessment, business profile and growth trajectory,” said Kumar.

LIC invested Rs 300 crore or 5% of the anchor portion in Adani Enterprises’ follow-on public offer (FPO). LIC holds a 4.2% stake in Adani Enterprises, 9.1% stake in Adani Ports and nearly 6% in Adani Total Gas. Sources said that Adani Group was not LIC’s top investment and the top two were other business houses. A Reuters report said that the corporation is unlikely to make any further investments in the FPO.

Meanwhile, the government announced the appointment of M Jagannath as LIC’s new MD. Jagannath, who was earlier a zonal manager, will take over from Raj Kumar whose term ends on January 31.

Punjab National Bank’s CEO Atul Kumar Goel, while announcing Q3FY23 results, said that the lender has an exposure of Rs 7,000 crore to Adani Group, of which Rs 2,500 is to the airport business. “The exposure is backed by cash flow and the investment is across 8-9 companies. We are keeping a watch on developments in the news, and as of date, there is no worry as there are cash flows,” he said.

#LIC #seeks #clarification #Adani #report