Adani: LIC nears all-time low on fears of loss in Adani Grp portfolio

[ad_1]

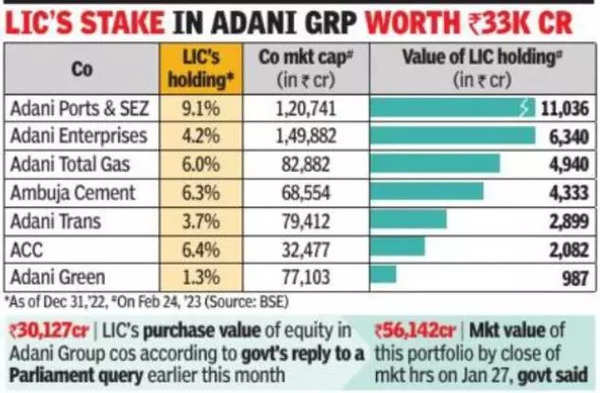

Although Adani Group insiders insisted that LIC had booked some profit in January this year when the stock prices were near their 52-week highs, the insurance major is yet to come out with any statement about the profit or loss status in its Adani portfolio. According to the last disclosures made to the BSE (see graphic), LIC’s biggest investment was in Adani Ports & SEZ, in which it had a 9.1% stake. It also held between 1.25% and 6.5% stakes in six other Adani Group companies. In the last one month, LIC’s stock has lost nearly 17% of its value.

Friday’s session saw seven of the 10 Adani Group’s stocks closing in the red. Of these seven, four stocks – Adani Total Gas, Adani Green Energy, Adani Transmission and Adani Power – closed at their 5% lower circuit level. Group flagship Adani Enterprises also closed 5% lower, but circuit breakers do not apply to this stock since it’s among those on which derivatives trading is allowed. Among other laggards, Adani Wilmar closed 3.3% lower while NDTV was down 4.1%. Of the remaining stocks, Ambuja Cements closed 2.4% higher while Adani Ports & SEZ was up 1.2%, and ACC closed unchanged.

IndusInd chairman quits Adani co board

Sunil Mehta, chairman of IndusInd Bank, has stepped down from the board of Adani Green Energy as the private lender has granted credit facilities to the company. The RBI had cleared the appointment of Mehta on January 31 and shareholders will vote to ratify the appointment.

#Adani #LIC #nears #alltime #fears #loss #Adani #Grp #portfolio